For those of you still working off Thanksgiving dinner, you may have missed the 900-plus-point drop in the Dow Jones Industrial Average. Unfortunately, for some, the decline forced investors to sell their own shares because of margin calls. As the WSJ reports:

Markets sold off worldwide on Friday after South Africa raised alarm about the new “variant of concern” that the World Health Organization named Omicron. The panic may be driven more by the fear of new government lockdowns and social distancing than by the variant itself.

The Dow fell 2.5% while U.S. crude prices tumbled 13% as the U.S. and other countries restricted travel to southern Africa. President Biden wants lower oil prices, and he may get his wish. But the frantic response by governments and markets may be overwrought given how little we still know about Omicron and how much we’ve learned during the pandemic.

You know I hate leverage when it comes to investing in stocks. My favorite investment is in You: as in your job, your creativity, and your own work. I don’t want you “hoping” the market does something for you. The market is historically bad to those in need.

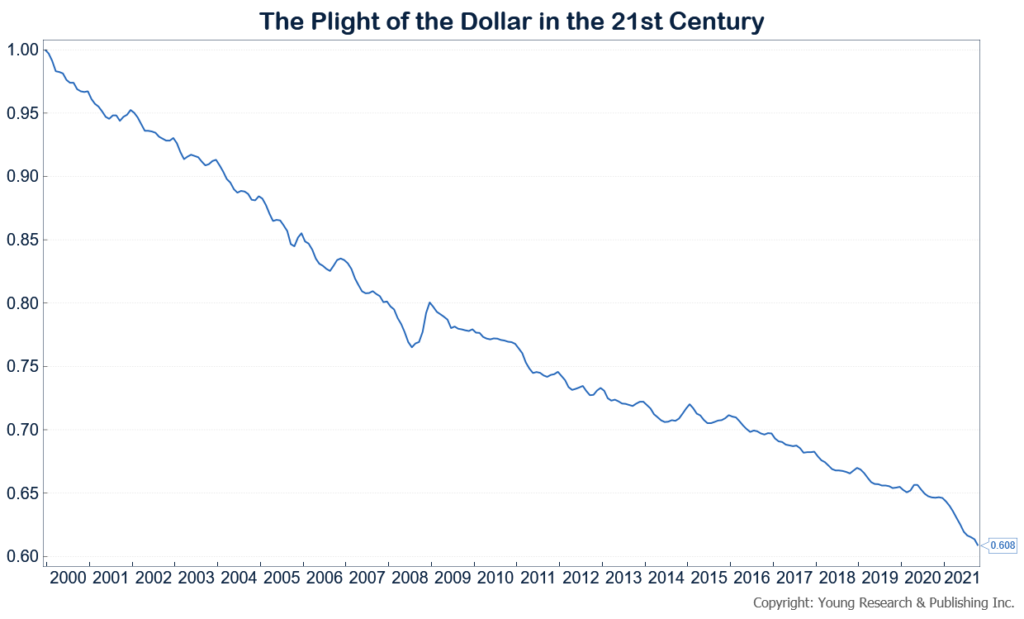

In this low interest rate environment, it’s shocking how difficult it is to get any return on cash. Just look at how valuable you are when you’re bringing in money.

Action Line: You never want to risk having a margin call. There’re ways to take advantage of market declines without using leverage. You can be a “buy low” investor with dividends by reinvesting them in times like these. Consistently reinvesting dividends will open up the power of compound interest. It’s best to begin compounding as early as possible, even right out of college. If you know a recent graduate, or someone in college today, send them a copy of my free Special Report: How to Invest After Graduating College.

P.S. Your Survival Guy is here to report on life in New Hampshire over the Thanksgiving holiday. Overall I’d say not as busy, by a long shot, as I’ve seen in years past. But, if you’re looking to take in a Bruins matinee game, you can’t beat Delaney’s Hole in the Wall. Instead of waiting for an hour and a half for food, we decided to take it home. That was, of course, before visiting Dickie at Stan and Dan’s who has outfitted my family into ski equipment for as long as I can remember.

Originally posted on Your Survival Guy.