Good companies don’t always make good investments. If you are a regular reader of this site you know we have written that often.

Coca-Cola is a great business, but if you would have purchased it at year-end 1999, ten years later you would have been looking at an average annual return of about 2%. Over the course of that ten-year period, Coke had an average return on capital of about 21% and its earnings tripled.

Why did the stock of one of the world’s great companies perform so poorly despite the impressive financial performance?

The 45X earnings that investors paid to buy Coke shares in 1999 was simply too high.

Under Armour (UA) is another firm that is considered a good company by many, but this morning its management reported earnings that missed analyst estimates. The shares plunged over 25%. From its high in 2015, Under Armour shares are down almost 60%.

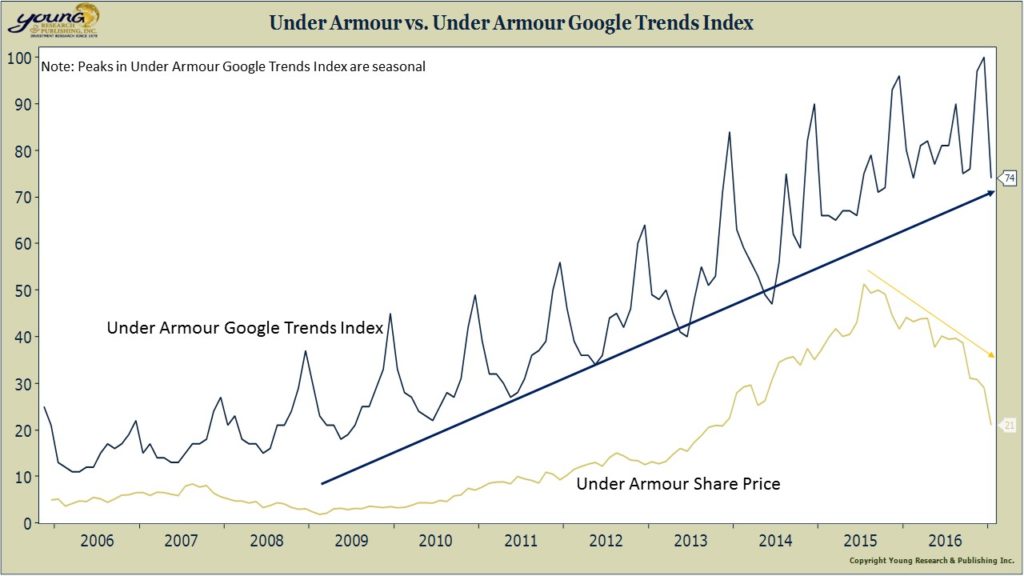

Under Armour is still as good a company as it was yesterday and the brand remains popular. As the Google Trends Index (an indicator of search traffic) on our chart below shows, UA is as popular today as it ever was. The problem for UA’s investors is the same problem Coke’s investors faced in 1999—UA’s valuation just got too high. At its peak in 2015, UA shares were trading for over 110X earnings.

It almost doesn’t matter how fast a company is growing, at 110X earnings the margin of safety is so infinitesimal that the slightest deceleration in growth can wreak havoc on a company’s share price as, it did with UA.

What is the actionable advice for you? It isn’t enough to just buy good companies. You have to buy good companies at reasonable prices. We invest with a margin of safety and advise the same strategy for you.