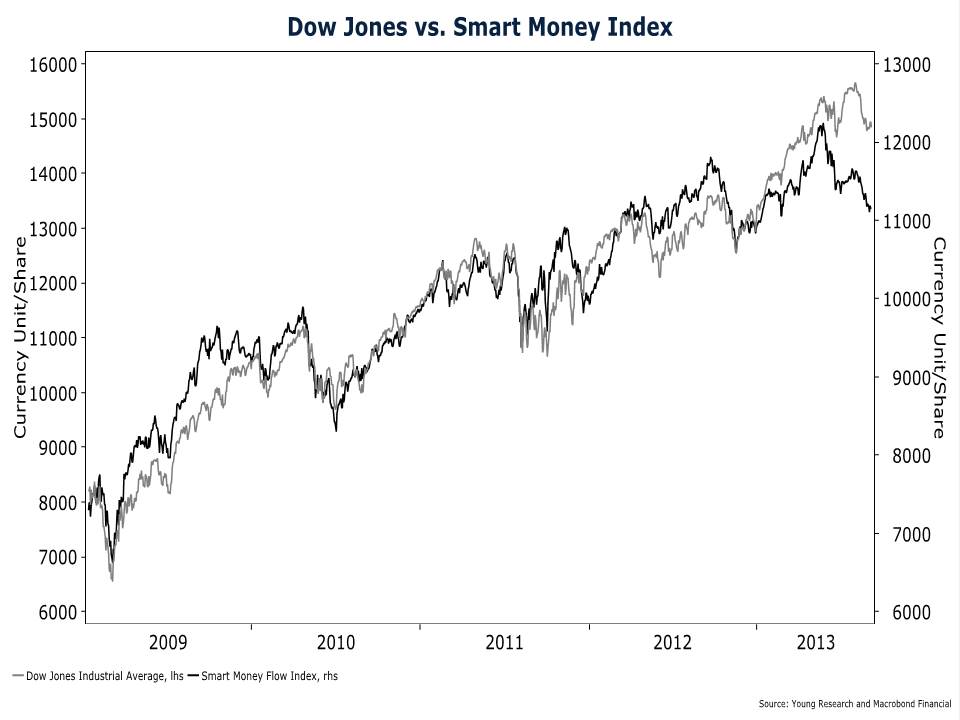

Since the spring of this year, the Smart Money Index (description below) and the Dow Jones Industrial Average have diverged significantly. This isn’t normal as the two track each other closely most of the time. With the smart money heading for the exits, investors should be cautious.

Bloomberg: The Smart Money Flow Index is calculated by taking the action of the Dow in two time periods: the first 30 minutes and the close. The first 30 minutes represent emotional buying, driven by greed and fear of the crowd based on good and bad news. There is also a lot of buying on market orders and short covering at the opening. Smart money waits until the end and they very often test the market before by shorting heavily just to see how the market reacts. Then they move in the big way. These heavy hitters also have the best possible information available to them and they do have the edge on all the other market participants. To replicate this index, just start at any given day, subtract the price of the Dow at 10 AM from the previous day’s close and add today’s closing price. Whenever the Dow makes a high which is not confirmed by the SMFI there is trouble ahead.