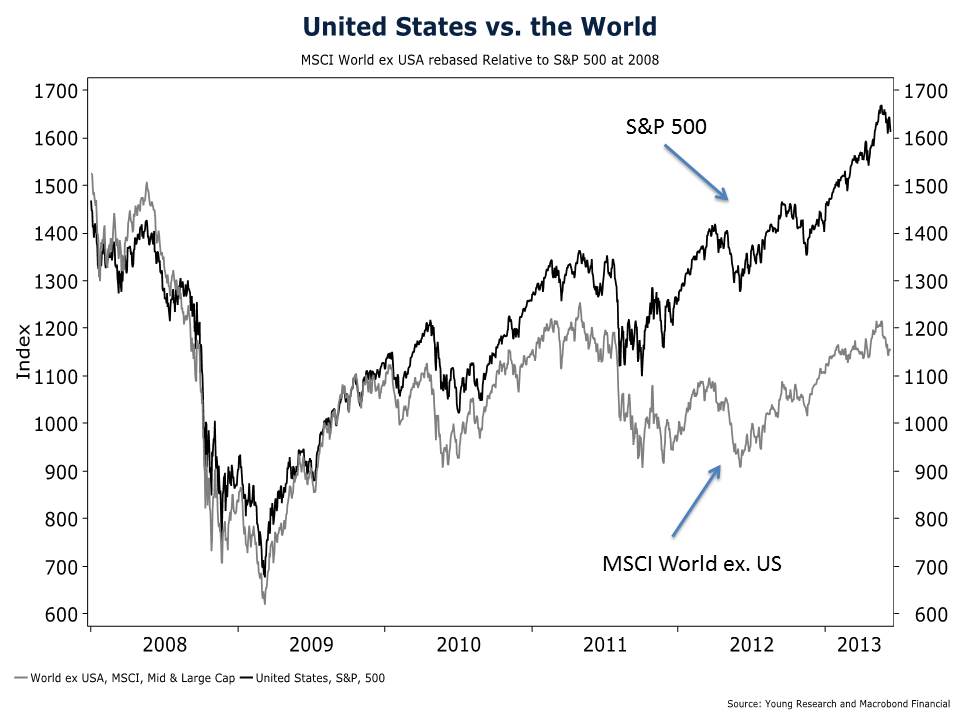

During the collapse of 2008 and through the rebound of 2009 U.S. markets and foreign markets closely tracked one another. But toward the end of 2009, and more so ever since, the U.S. has diverged from world markets.

While the rest of the world has developed a very flat look, the S&P 500 has reached new highs. Whether or not this is the effect of the Federal Reserve debasing the world’s reserve currency, it leaves a big question mark as to what to expect from second quarter earnings at U.S. multinationals.

In 2011 (latest data available), 46.1% of S&P 500 sales came from outside the United States. That’s nearly half. Given the declining prices for foreign stocks, isn’t it reasonable to assume that some of that weak economic momentum will sneak into U.S. multinationals’ bottom lines?

But investors keep buying up American stocks, seemingly without consideration for the sorry state of the world’s economic growth. You can see in the chart below that the world’s stock market has formed an L-shaped recovery. Meanwhile, the S&P 500 is developing a more parabolic look every day.

Be cautious about your investments. Don’t let Ben Bernanke railroad you into taking on more risk than you’re comfortable with.