Shariq Khan and Chen Aizhu of Reuters report that demand for used cooking oil (UCO) from U.S. renewable diesel producers has grown much faster than domestic supply, causing a flip of exports and imports, but the future remains uncertain. They write:

U.S. imports of used cooking oil (UCO) from China are set to hit a record in the months ahead, even as regulatory uncertainty casts doubts over longer-term prospects of a trade that boomed last year, according to market participants.

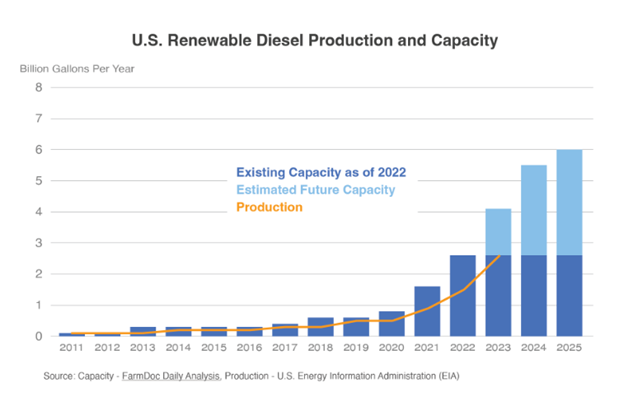

U.S. demand for UCO, a feedstock for biofuels like renewable diesel, has surged as federal and state governments launched incentives to support the industry as they aim to decarbonize transportation. That sparked such a frenzied rush to build new renewable diesel plants that U.S. capacity more than doubled from 2021 to 282,000 barrels per day in 2023, according to government data.

The rapid surge flipped the U.S. from a net exporter of UCO until 2021, to a net importer since 2022. U.S. imports surpassed 1.36 million metric tons (mt) last year, up from about 400,000 mt in 2022, the data showed.

“Demand for UCO from U.S. renewable diesel producers has grown much faster than domestic supply,” said Duane Dunlap, owner of renewables consultancy DNS Enterprises.[…]

Another major upheaval for the global UCO trade will come from Beijing’s widely anticipated announcement of Sustainable Aviation Fuel (SAF) production targets. Since SAF also uses UCO as a feedstock, China’s push into that market could dry up its UCO export capacity in about five years, one of the traders in Singapore said.

“There is a lot of uncertainty right now surrounding future policymaking, but as long as the U.S. does not ban it — which we see as unlikely in the short-term – UCO imports will grow,” said Zander Capozzola, vice president of renewable fuels at AEGIS Hedging.

“It’s just a question of where these imports will come from.”

Read more here.