In 2024, the United States exported about 30% of its total energy production—mainly fossil fuels—marking a record 31 out of 103 quadrillion BTUs, according to the US Energy Information Administration. Crude oil, natural gas, and coal exports rose significantly, especially to Europe and Asia, driven by global demand, expanded export capacity, and geopolitical shifts like Europe reducing its reliance on Russian energy. Mexico was the top destination for oil and gas, while India led for coal. The US also exported over half of its crude oil and NGPL production and 20% of its natural gas, reflecting strong growth in production and global energy trade. The EIA writes:

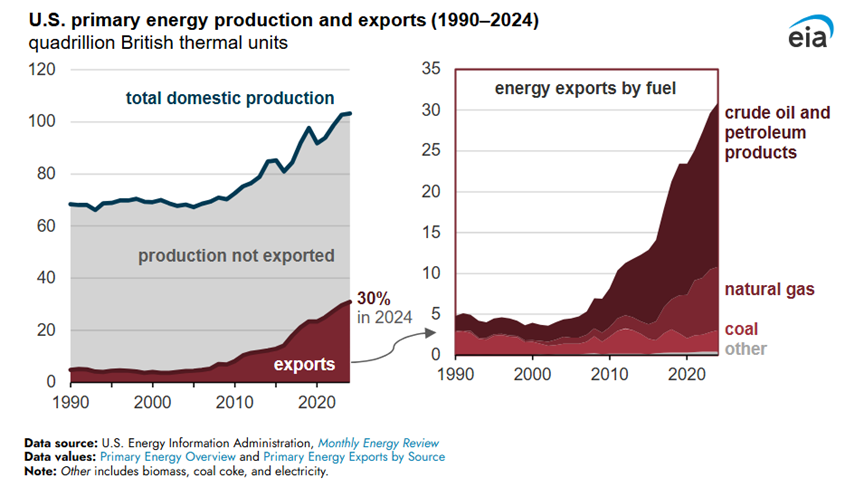

In 2024, the United States exported about 30% of its domestic primary energy production. This percentage has grown considerably in recent decades, according to data in our Monthly Energy Review. Nearly all of the exports were fossil fuels destined for other countries in North America, Europe, or Asia.

The United States set multiple records for energy production and exports in 2024. Of the record 103 quadrillion British thermal units (quads) of total primary energy production in the United States, a record 31 quads went to other countries. The energy production that is not exported is not necessarily equivalent to domestic consumption because domestic consumption also includes energy imports and withdrawals from storage.

In our Monthly Energy Review, we convert different measurements for different sources of energy to one common unit of heat, called a British thermal unit. We use British thermal units to compare different types of energy that are not usually directly comparable, such as barrels of crude oil and cubic feet of natural gas. Appendix A of our Monthly Energy Review shows the conversion factors that we use for each energy source.

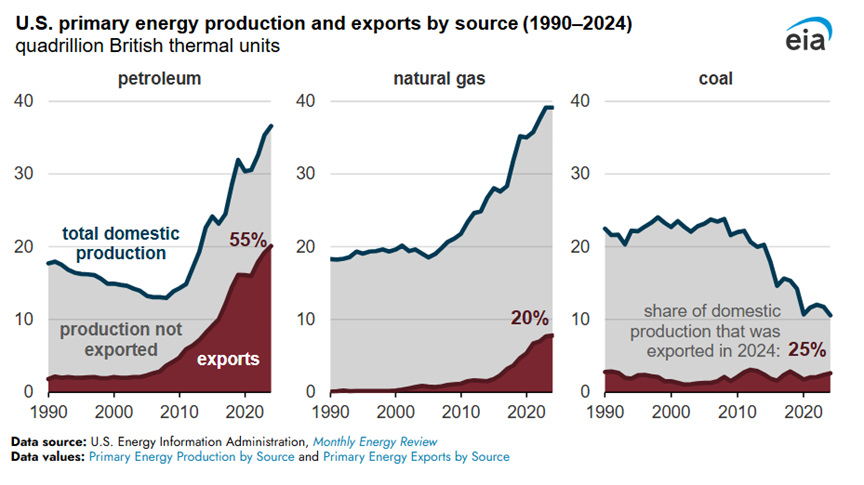

In 2024, the United States exported 55% of its domestic crude oil and natural gas plant liquids (NGPL) production either directly as crude oil or as processed petroleum products such as propane, distillate fuel oil, and motor gasoline. During the past decade, U.S. crude oil and NGPL production as well as crude oil and petroleum products exports grew rapidly, outpacing modest domestic petroleum demand growth and declining U.S. imports.

Most of the petroleum exports growth went to countries in Europe and Asia, which was facilitated by several factors:

The United States removed restrictions on crude oil exports in 2016.

Domestic exporting infrastructure expanded as global demand increased.

Europe banned seaborne crude oil imports from Russia in 2022.

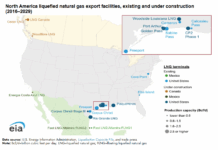

In 2024, the United States exported about 20% of its dry natural gas production. During the past decade, U.S. natural gas production and exports grew faster than domestic demand and imports. Most of the exports growth during the past decade went to countries in Europe and Asia, in part because of expanded domestic liquified natural gas (LNG) export capacity and increased European demand following Russia’s invasion of Ukraine in 2022, which reduced natural gas shipped to Europe from Russia.U.S. coal exports account for a larger share of a shrinking market, and in 2024, the United States exported about 25% of its coal production. During the past decade, U.S. coal production, consumption, and imports declined as operators retired many domestic coal electric power plants. U.S. coal exports to countries in Asia and Africa increased, and exports to Europe declined.

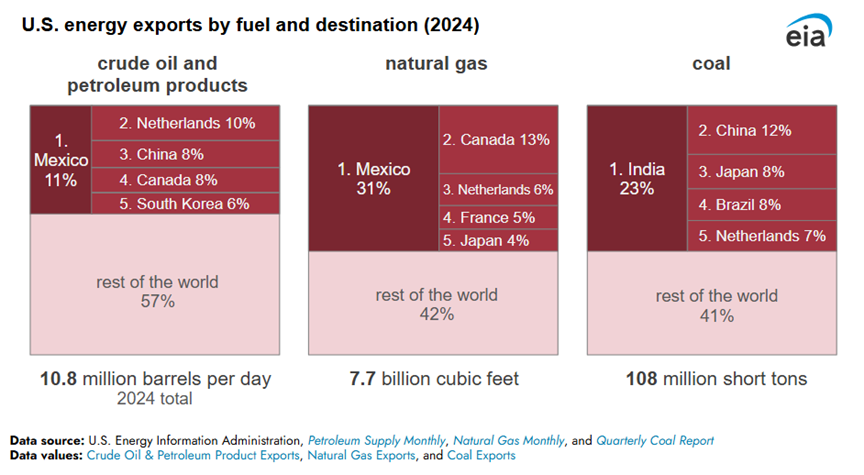

In 2024, Mexico was the top destination for U.S. exports of both crude oil and petroleum products as well as natural gas. India was the top destination for U.S. coal exports. With its large storage and regional trading hub located in Rotterdam, the Netherlands was a top five destination for U.S. petroleum, natural gas, and coal in 2024, but those exports may later be sent to other countries in and around Europe.

Read more here.