Welcome to the first post in our new Stock Market Movers column. This new area of the website will focus on explaining and analyzing some of the market’s best and worst performing stocks. The focus will be on stocks reaching 52 week highs and lows, and those with extreme short term price changes. Below you’ll find the first addition to this new column, a review of a much lauded Chinese water industry company.

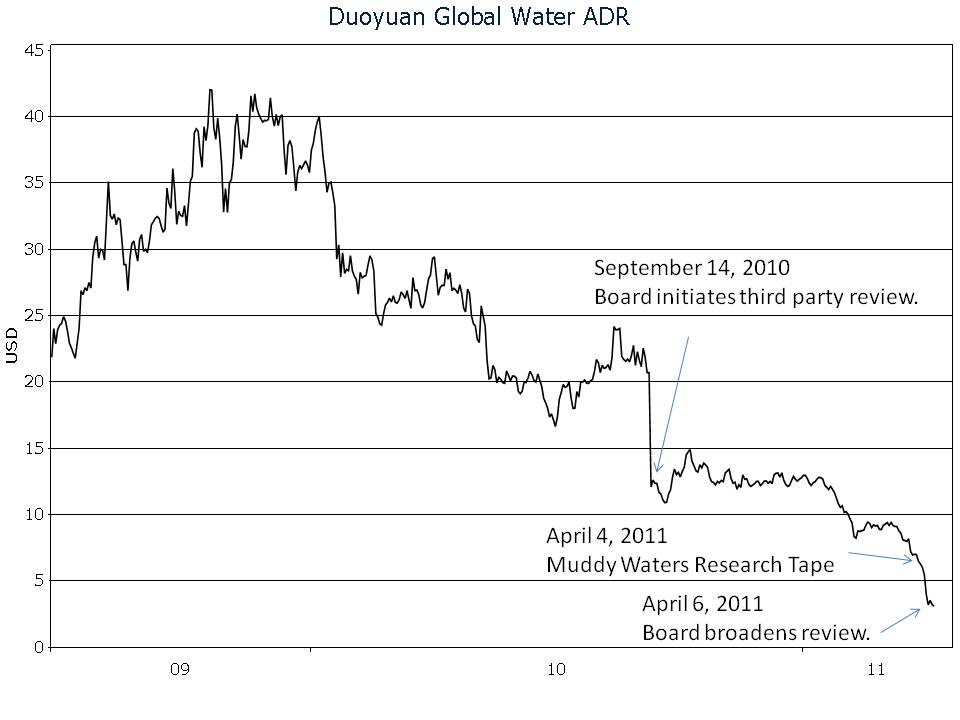

Hitting a new low last week, was China based Duoyuan Global Water. The one-time high flying Chinese water play, closed at $3.11 yesterday, 86% below its $22.65 June 2009 IPO price.

Duoyuan Global is under investigation for its business practices. Lawsuits have alleged improper accounting between Duoyuan Global and a related company, Duoyuan Printing. The NYSE has moved to delist Duoyuan Printing because it hasn’t been able to file required SEC statements.

On April 4, 2011, Muddy Waters, an outfit that researches fraud in Chinese companies released a damning video of calls to Duoyuan Global. The call rang numbers listed for Duoyuan Global sales offices that were disconnected. (See the video)

We don’t follow Duoyuan Global at Young Research, but this certainly has the appearance of fraud. And Duoyuan Global Water is an NYSE listed firm that files financial statements with the SEC. The company was also covered by three mid-tier Wall Street firms up until late last year. The Duoyuan case should serve as a warning to investors buying U.S. listed Chinese small-caps. Just because a stock is listed in the U.S. and files financial statements with the SEC doesn’t guarantee that it is free of fraud.