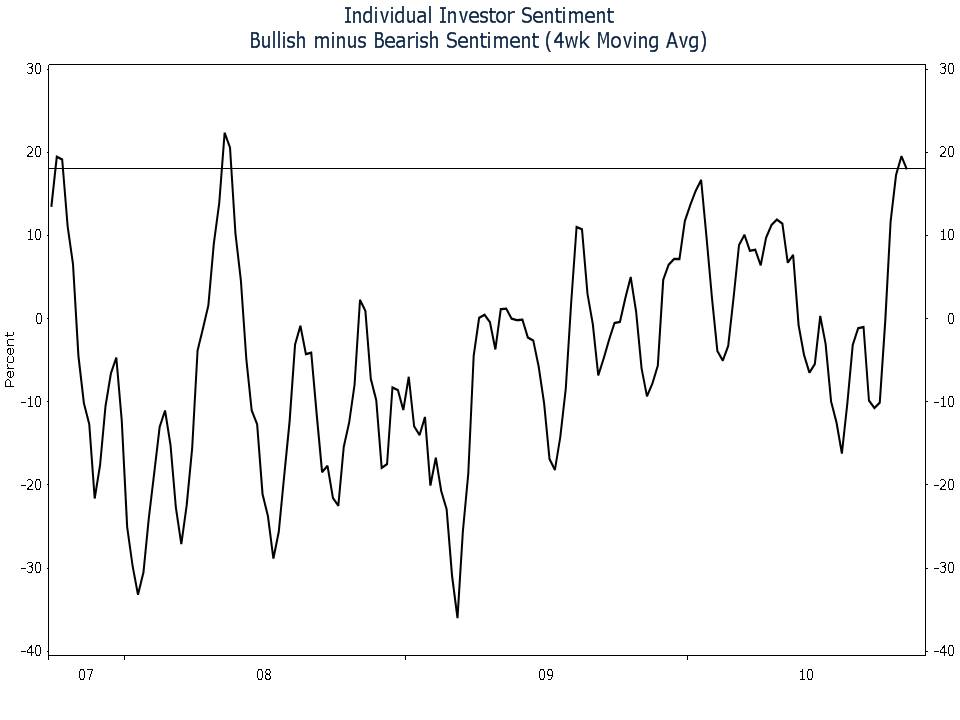

The sentiment survey done by the American Association of Individual Investors (AAII) shows that individual investors are bullish on stocks. The AAII’s weekly investor sentiment survey asks members if they are bullish, bearish, or neutral on the stock market for the next six months. Last week, 47.1% of respondents were bullish, and only 26.8% were bearish. That’s a spread of 20 percentage points, which is high based on recent history. As you can imagine, the weekly investor sentiment survey can fluctuate quite a bit from week to week, so it is useful to look at a moving average. I smooth the weekly fluctuations out by using a four-week moving average. My chart shows the smoothed difference between bulls and bears in the AAII survey. Bullish sentiment is just a tick below its post-Lehman high and at the top end of its three-year range.

There is no doubt that individuals have become more bullish since the Fed signaled it may print more money to boost asset prices. Who wouldn’t be bullish? The Fed is now targeting asset prices, so your downside will be limited, right? That may be true, but here’s the rub. The stock market is a discounting mechanism. It’s no secret that the Fed plans to print more money as soon as its November meeting. Investors have already started bidding up stocks in anticipation of Fed action. The S&P 500 is up more than 11% since the end of August. The difficulty in investing is judging what has already been discounted by the market. If the stocks are discounting another $1 trillion liquidity injection and the Fed only delivers $500 billion, the downside could be significant.

When bullish sentiment is at extreme levels, who is left to push prices higher? There is only one way for sentiment to go, and that’s down. The last two times that my bullish sentiment indicator reached these heights, stocks were down double digits six months later. I’m not forecasting lower stock prices, but I continue to invest with caution, and I advise the same approach for you. Throwing money at the market may push up prices temporarily, but without real fundamental improvement, the gains will not be sustainable.