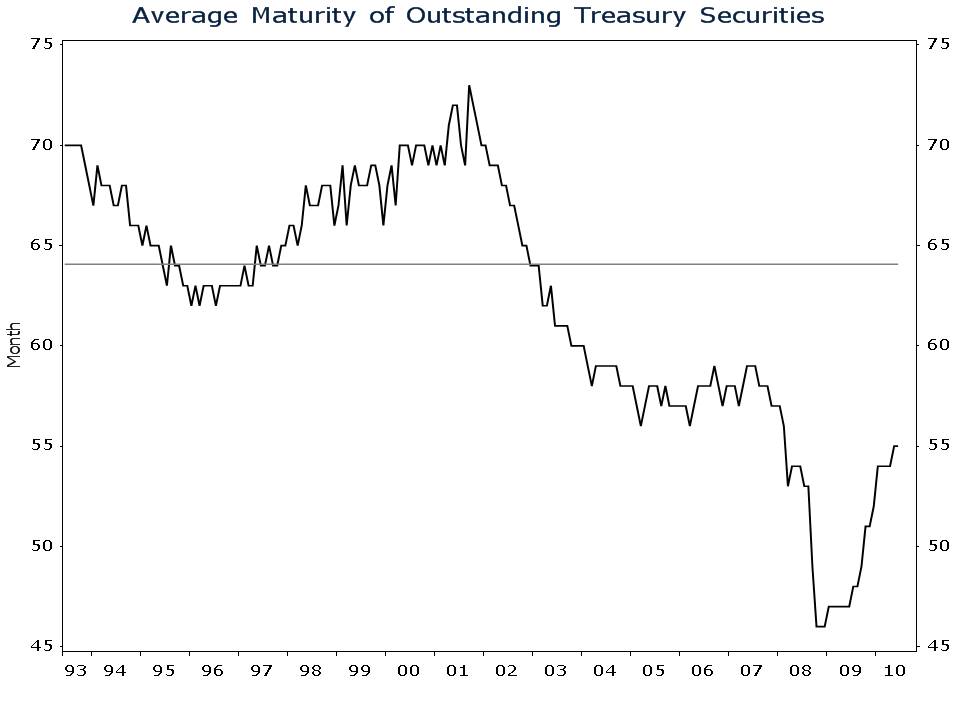

Long-term interest rates are at their lowest level in over four decades. Today, the Treasury can borrow money for 30 years at an interest rate of less than 4%. Adjusted for trend inflation, Uncle Sam is looking at a rate below 1%. Long rates of less than 4% are even more surprising given the sorry state of public finances and the vast supply of high-powered money sitting on bank balance sheets. The prospect of an oversupply of treasury issuance or rising inflation could send interest rates soaring. Long bonds would get crushed in such a scenario. Today’s ultralow long bond rates are a grave threat to investors, but a compelling opportunity for borrowers. The private sector has recognized the opportunity. The mortgage refinancing index is surging, and long-term corporate debt issuance is booming. Unfortunately, the Treasury department hasn’t caught on. Our esteemed Treasury secretary is issuing more short- to intermediate-term bonds than long bonds. The average maturity of outstanding treasury debt is only 4.5 years, below its long-term average. By borrowing at the short- to intermediate-term end of the maturity spectrum, the U.S. government is missing an opportunity to lock in a low interest expense on the public debt for 30 years.

Be sure you don’t follow the Treasury’s lead. If you have outstanding high-interest-rate mortgage debt, consider refinancing today. You may never see mortgage rates this low again.