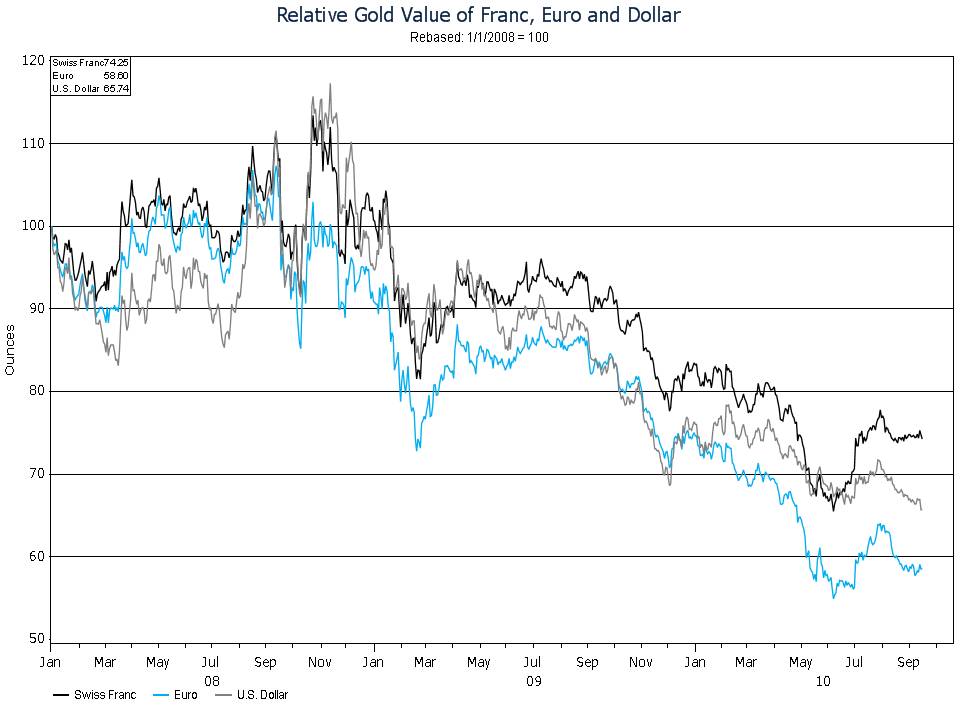

Gold reached a record high on Tuesday, closing at $1,271.70 per troy ounce. It is up over 15% this year. That’s great for gold investors, but what does it mean for the currency in which it’s being quoted, the U.S. dollar? Relative to gold, the dollar, as shown in the chart below, is worth only two-thirds what it was worth at the beginning of 2008, just after the start of the market crash. The euro has maintained 60% of its value compared to gold, and the Swiss franc has retained a more impressive 75% of its value. Gold has had a tremendous run relative to all three currencies. This is not surprising. The yellow metal does well in times of trouble.

So where does the relative gold value of all three currencies go from here? Gold could certainly continue to gain more ground on all three, but notice how the Swiss franc seems to be consolidating. Of the three currencies, the Swiss franc certainly appears to be the favored store-of-value currency relative to gold. So before you load up on gold, don’t forget to look at its relative value in currencies other than U.S. dollars. There’s no rule stating that the recent trend must continue.