November 20, 2009

In 1981, the Dow Jones Industrial Average ended at 875, 10% lower than its year-end value in 1965. During this wretched 16-year period, blue-chip stocks went nowhere. This was the ice age for stock prices. High and rising inflation and interest rates and big government were to blame. This sounds eerily similar to America’s prospects today.

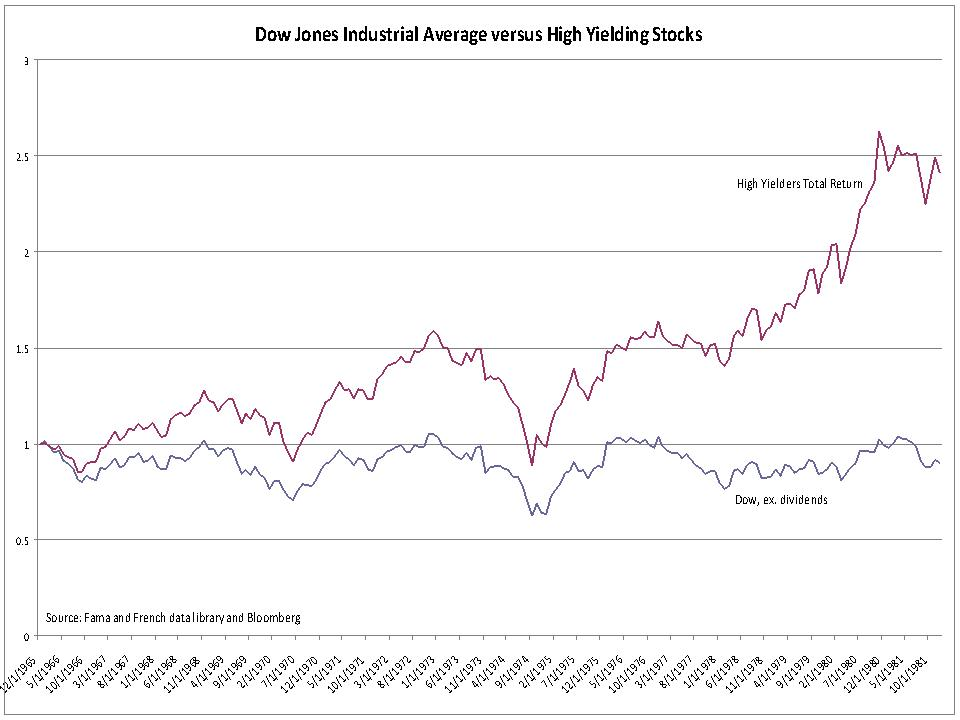

Savvy investors have successfully navigated long dry spells in the stock market for decades. What is their secret? Buy the high yielders. My chart compares the hypothetical growth of a $10,000 investment in the Dow Jones Industrial Average, ex dividends, to the growth of a $10,000 investment in the highest-yielding U.S. stocks. The highest yielders are defined as the top-yielding quintile of U.S. exchange-traded stocks. The portfolio of high yielders compounded at 6.4% annually over this 16-year period, compared to a loss on the Dow. For conservative investors and those approaching or in retirement, investing for yield is a must. At my family-run investment company and in my monthly strategy report, we focus exclusively on dividend-paying stocks. Please join us.