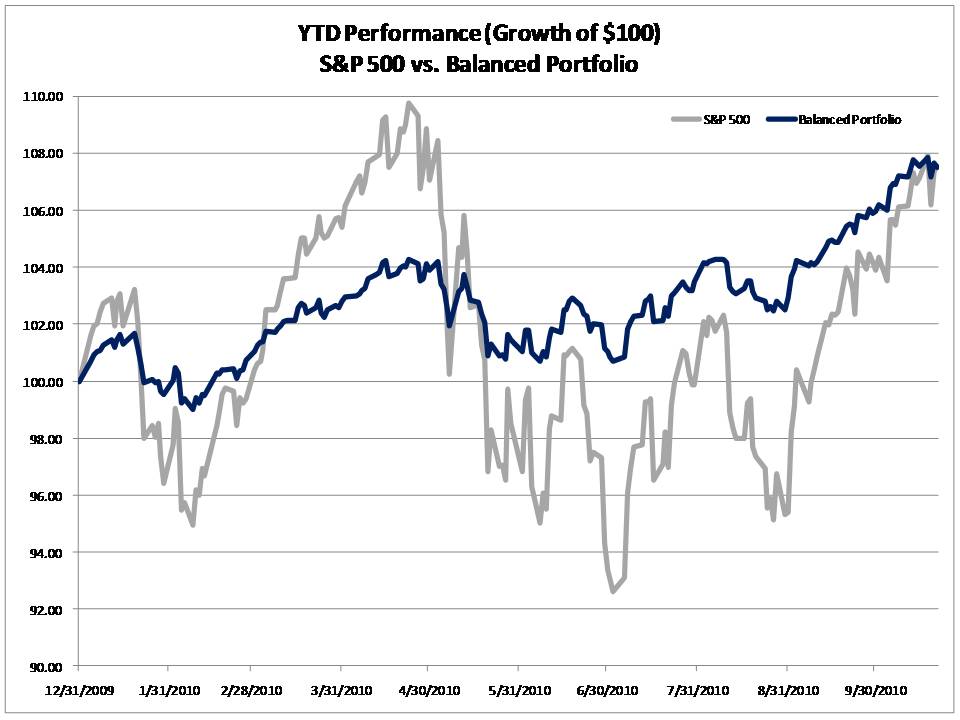

Including dividends, the S&P 500 is now up 7.5% YTD. Not bad. At a 7.5% compounded annual return, you would double your money every 10 years. But when you consider the volatility that stock market investors had to endure to earn that 7.5%, it doesn’t sound so compelling. Study my chart below. The grey line is the growth of a $100 investment in the S&P 500 at year-end 2009. To start the year, the S&P fell more than 4%. Then it rallied about 15% over the ensuing three months. When sovereign debt issues intensified in Europe, the index sold off sharply, falling more than 15% from its high only two months earlier. From early July to early August, stocks jumped 10%, but then fell almost 7% over the following month. Since the end of August the S&P has gained almost 15%. The ups and downs are enough to give one a painful case of whiplash.

Instead of investing entirely in stocks, I advise my subscribers to take a balanced approach. I favor portfolios that include fixed income, stocks, currencies, and gold. For 2010, I’ve recommended as a general point of reference a 60-30-10 mix of fixed income, stocks, and currencies and gold. In the chart below, I assume a portfolio with 60% split between investment grade corporate bonds and agency mortgage bonds, 10% split between gold and the Swiss franc, and 30% in the S&P 500. In practice, for the stock portfolio, I favor dividend payers only, but the S&P is a suitable stand-in for purposes of comparison.

The YTD return of my balanced portfolio matches the return of the S&P 500, but with less than half the volatility. When the S&P fell more than 15% in May and June of this year, my balanced portfolio gave up only 3%. And when the S&P jumped 15% in the last two months, my balanced portfolio gained about 5%. Both the S&P and my balanced portfolio are up 7.5% YTD, but the balanced portfolio had a much smoother ride.

For investors in or nearing retirement, the gut-wrenching volatility of an all-stock portfolio can lead to sleepless nights and emotionally charged investment decisions. A balanced approach offers the comfort and peace of mind necessary for long-term investment success.