In 2012 variable annuity cases were the only class of security where arbitration cases increased. Recently, Diany Nygaard, a Kansas City, MO based lawyer said she has been “besieged” by investors claims, as reported in The WSJ. “[Brokers] will stand up in front of a room and sell what they tell people are tax free, high income, you-can’t-lose-your-money investments…That’s the shtick.”

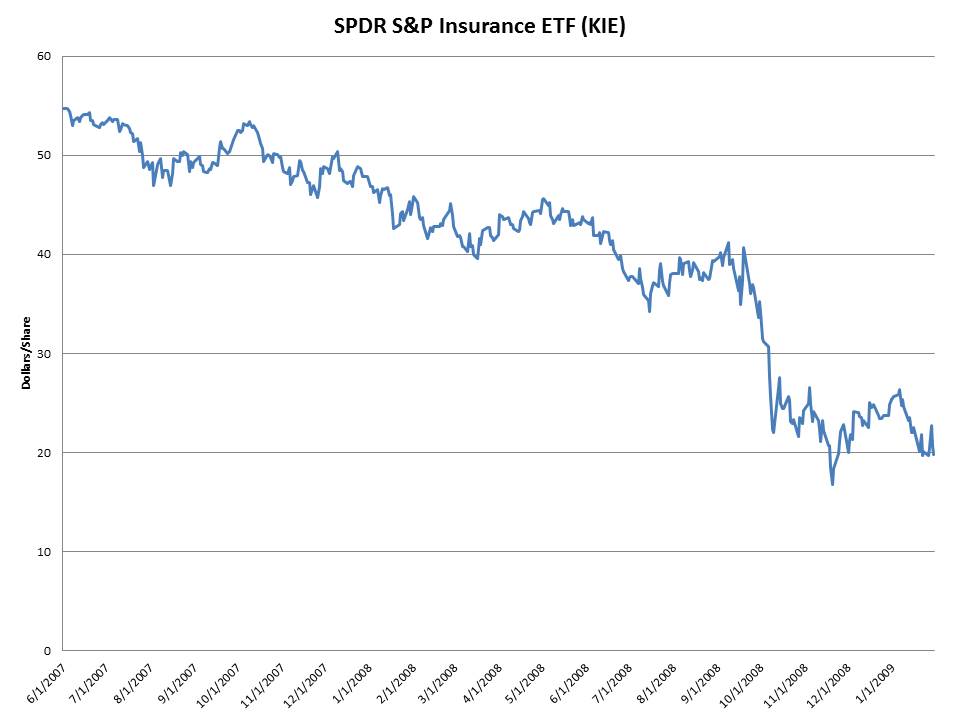

Investors in variable annuities are at the mercy of the issuing insurance company. Take a look at the chart below. It’s an ETF of insurance companies. It gives you a snapshot of how they performed when times were tough. Variable annuities are only as good as the issuing insurance company’s ability to pay. Variable annuity investors were sweating it big time as their insurers’ stock prices cratered. Next time, the government may not be there with a bailout.

E.J. Smith works with new investors that have $2 million or more to invest. He can be reached at: ejsmith@youngresearch.com