“Stockholders as a class are king. Acting as a majority they can hire and fire managements and bend them completely to their will.” – Benjamin Graham, The Intelligent Investor

Corporations have been buying back shares at a record pace, buying mores stock than any other group of investors today including: Hedge funds, foreigners, insiders, pension funds, insurance companies, and individual investors.

In the first quarter of this year corporations purchased $188 billion of stock—the highest quarterly amount since 2007, according to Birinyi Associates.

We all know how stocks did after 2007.

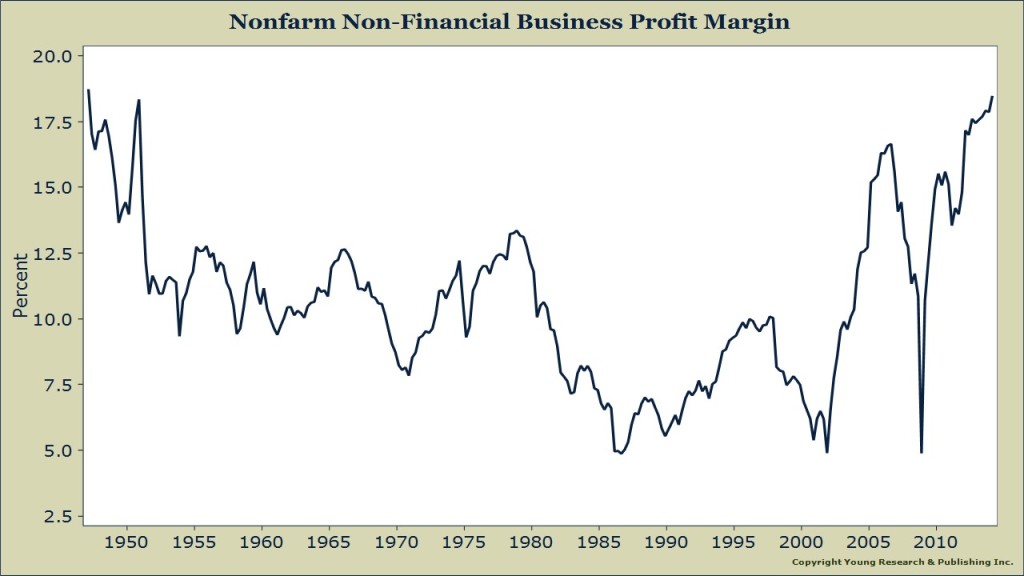

In buying back their stock, corporations reduce the number of shares outstanding. With profit margins near a 65-year high, they do this to goose quarterly earnings per share—putting lipstick on the pig. They are reducing the number of slices in a pie, but the size of the pie is still the same.

Greedy corporate insiders buy back shares, pump up earnings per share, and hope their stock options go up. That’s not protecting shareholders, it’s self serving.

What the big shots should do instead is return the money in the form of dividends to their shareholders. After all it’s the shareholders that own the company and it’s shareholders that have a right to receive the cash it produces without killing the company.

The golden goose can lay only so many eggs.