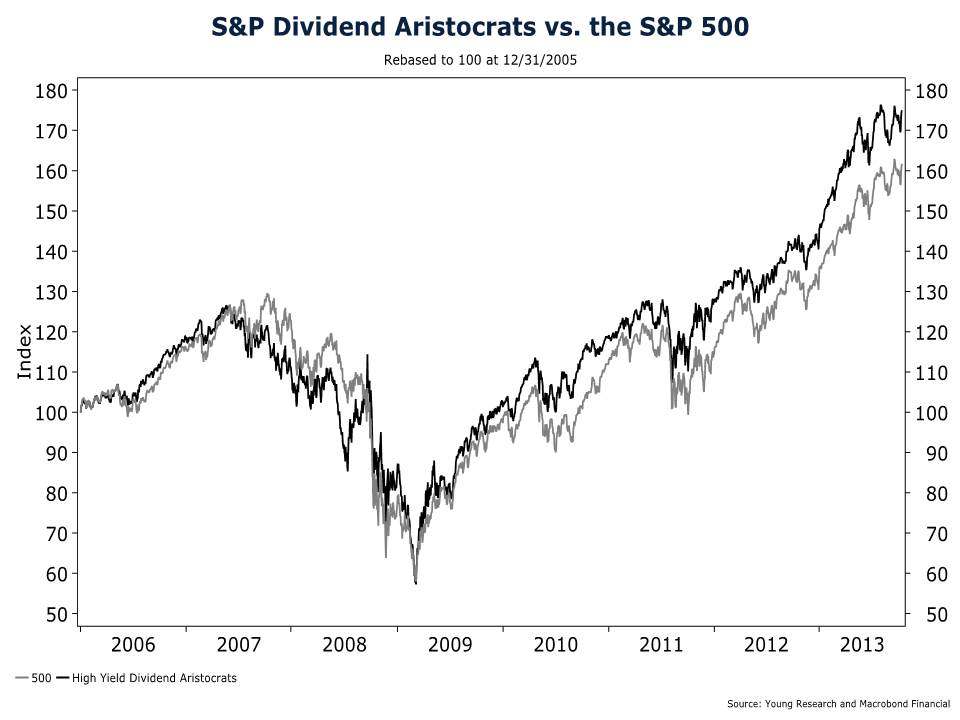

Your key to surviving market volatility is to make sure you have dividend paying stocks. With dividends you’re a winner each and every year. As a dividend-centric investor your goal isn’t to sell stocks at a higher price. It is to hold onto stocks that pay you a rich dividend. As you can see in this chart, losing money can happen literally overnight. Most investors get out at the wrong time—on the way down. But when you invest for dividends you’re not a seller or a buyer—you’re a collector. And collecting rare and hard to find dividends turns out to be quite fun. As you can see from the chart below, the high yielding S&P Dividend Aristocrats index outperformed the S&P 500 index by 8.2% from the end of 2005, through the Great Recession and until the present.

E.J. Smith works with new investors that have $2 million or more to invest. He can be reached at:ejsmith@youngresearch.com.