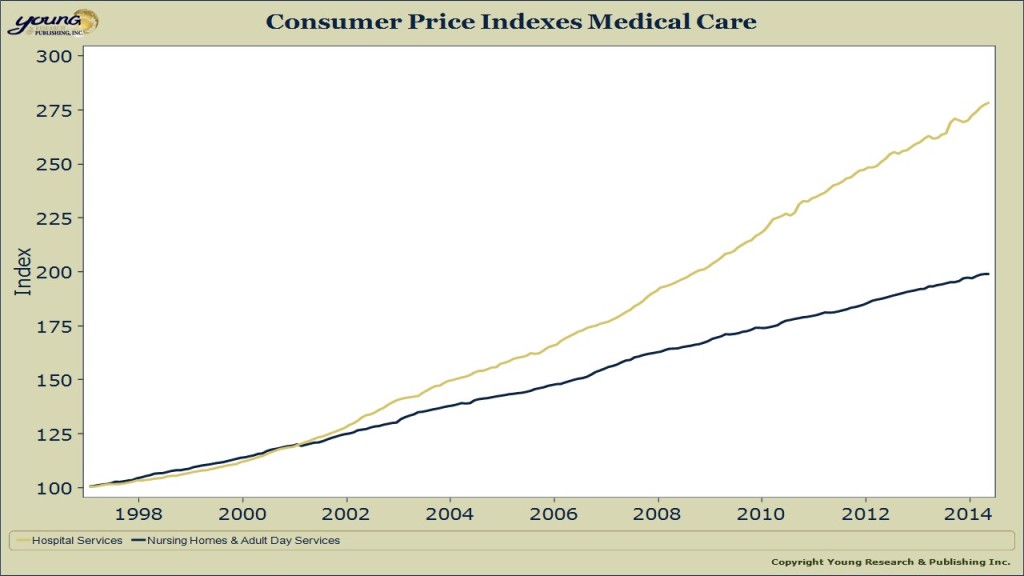

Have you added the cost of healthcare to your retirement planning? Fidelity has estimated that a 65-year old couple retiring in 2014 will need $220,000 to cover their healthcare expenses through retirement. It’s no surprise if you’ve paid attention to the fast increasing costs of medical care. Since 1997, costs for nursing homes have nearly doubled. And costs of hospital services are on their way to tripling.

You need to start planning now to cover any extra medical expenses during retirement. You might even change your retirement timeline. Fidelity estimates that just prolonging retirement from age 62 to age 65 can save an average couple $17,000 in healthcare costs alone.

Your particular health care costs in retirement will vary, of course, depending on your health and insurance and other medical costs. But another critical factor is when you retire.

Fidelity estimated the possible extra health care costs for couples who start their retirement at 62, as well as potential savings for those who can delay it to 67. Similar to the decision preretirees make about when to start claiming Social Security,4 health care costs should be factored into the retirement timing decision.

Couples who opt to retire at age 62—instead of 65—can anticipate an additional estimated annual cost of $17,000 per year, for a total of $271,000 during retirement. The extra costs include health insurance premiums for the period prior to Medicare eligibility and estimated out-of-pocket costs. On the other hand, the potential annual cost reduction for couples who can delay retirement to 67 could be $10,000 per year, reducing their estimated costs for health care in retirement to $200,000.

“We understand that some people don’t have a choice in when they retire,” Kimler says. “Sometimes health issues or someone’s occupation plays a role. So it’s critical that people plan well in advance for the considerable cost of health care by adding it into their overall retirement planning discussions.”