There’s trouble a brewing according to Dow Theory. The Wall Street Journal’s Paul Vigna reports here.

This time it’s Dow theory adherents, who are troubled that there’s been a breakdown this month that could spell trouble for the bull market, according to research the Wall Street Journal cited Tuesday.

The market looked weak on Monday, saved only by a late spurt of buying that narrowed the losses. It may not be the last time it looks weak.

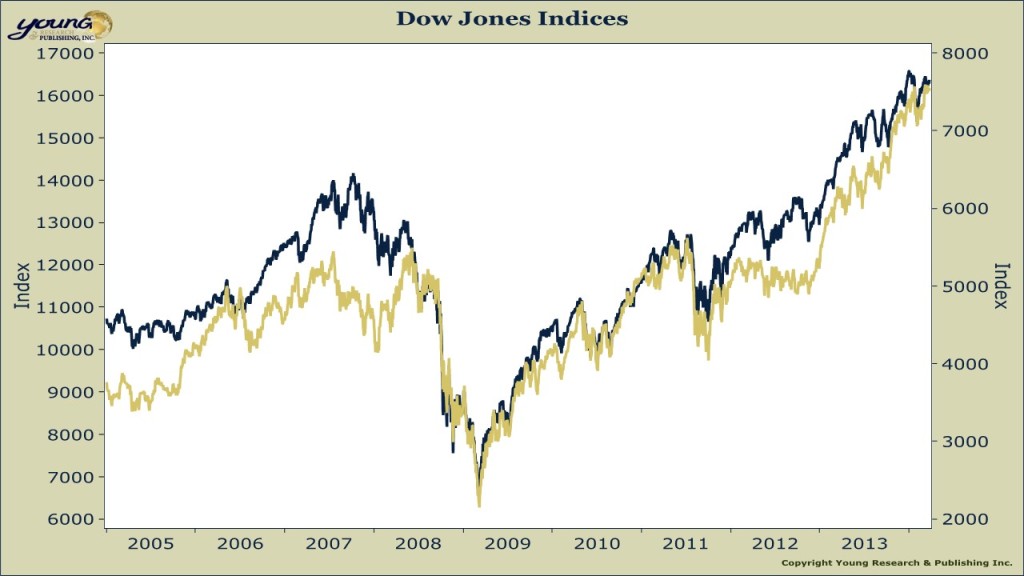

The much ballyhooed Dow Theory is flashing a warning sign: While the Dow Transports made a new high in March, the Dow Industrials did not. The latter’s failure to hit a new high is currently a red flag.

“This leaves a Dow Theory non-confirmation still in place,” said technical analyst JC Parets, founder of Eagle Bay Capital.

Why? Well followers of the century-old Dow Theory–popularized by Charles Dow–maintain the industrials and transports need to move in lockstep to confirm a market’s trend. A pattern of higher highs and lower lows serves as confirmation of the market’s move.

The theory is based on the thinking that making goods is one leg of the industrial economy and moving those goods around is the second leg, so their trends should be in sync.

Since the Dow Transport hit a year-to-date high of 7627.44 on March 7, both the transports and industrials have sagged. The Dow Transport closed at 7510.38 Monday, while the Dow industrials finished at 16276.69.

To see another buying signal, the Dow industrials would have to

cross above its early March levels, while the transports would need to maintain its momentum.