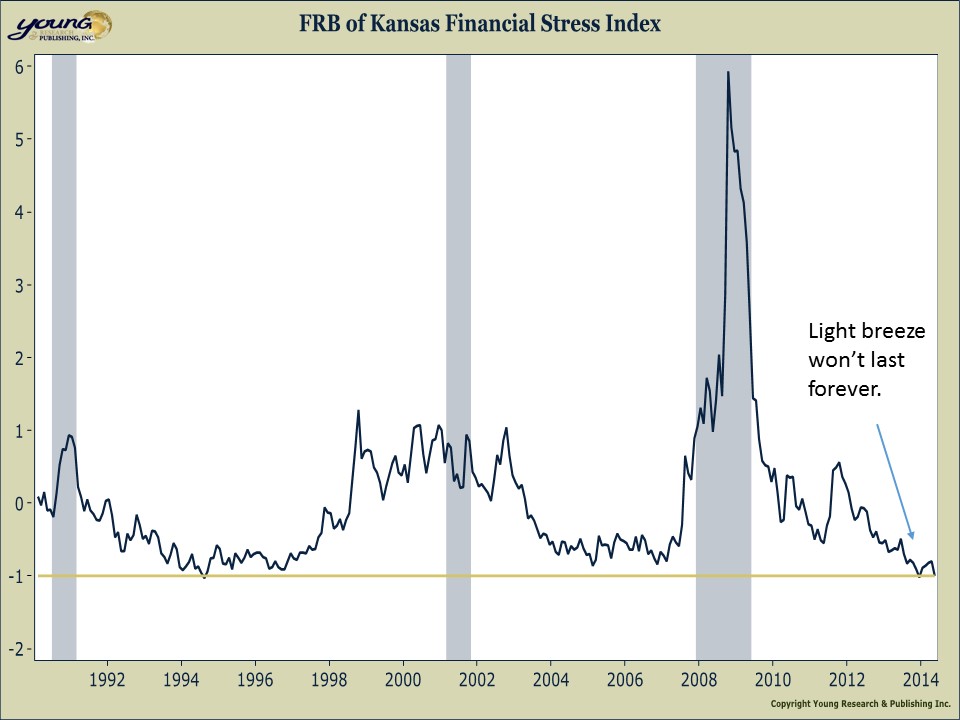

You need to check out this stress index. The Kansas City Financial Stress Index is a monthly measure of stress in the U.S. financial system based on 11 financial market variables—including the high-yield bond/Baa spread, volatility (VIX), and the correlation between returns on stocks and Treasury bonds. As you can see in the chart below there’s not a lick of stress to be found. It’s like sailing in a light puff of wind on a Summer afternoon here in Newport, RI.

But light puffs of wind don’t last forever. There’s a reversion to mean coming that’s more like the 15-20 knot wind on a typical Summer afternoon. That’s why the Fed needs to act now and raise its Fed funds rate. If it doesn’t, the FOMC will have nowhere to go with zero percent rates when financial stress strikes again. The easy sailing won’t last forever. Economist David Malpass points out the following his WSJ piece:

Until the January taper, bank loans and U.S. private-sector credit had been growing very slowly. Since then the Fed’s weekly data show that bank loans to private businesses have accelerated sharply and are on track to grow by $700 billion in 2014 after only growing $140 billion in 2013. The Fed’s flow-of-funds data released June 5 showed that credit to small businesses reached $4.2 trillion on March 31, up 3.8% over the past 12 months, topping the nominal GDP growth rate (of 3.4%) for the first time in the post-crisis expansion. Previous upward crossovers in small business lending like this only occurred in 1984, 1996 and 2004, each of which signaled periods of strong growth and small-business job creation.

It is vital that the Fed take this opportunity to move interest rates above zero. New York Fed President Bill Dudley gave a strong justification for rate hikes on May 20: “It would be desirable to get off the zero lower bound in order to regain some monetary policy flexibility.” Kansas City Fed President Esther George expressed urgency on May 29 at a Hoover Institution monetary conference: “I would like to see short-term interest rates move higher in response to improving economic conditions shortly after completion of the taper.”

The policy environment also has improved substantially since 2012, supporting the case for a higher fed-funds rate. The growth in federal spending and debt has slowed. There’s lower risk of U.S. tax rate increases than in 2010-12. And European Central Bank President Mario Draghi provided a forceful defense of the euro in 2011 and 2012, explaining lower bond yields there.