You can feel rich and poor at the same time. Take the college student living large on Mom and Dad’s tab. He may be enjoying his last semester of college but could also have a knot in the pit of his stomach; come next month, he graduates with no job.

The same up-and-down feeling might apply to the purchasing power of your dollar today. For example, you can feel rich by being a vulture investor in Florida and buying a condo at a deeply discounted price. But then you’ll feel poor driving south when your snowbird daydreams are abruptly interrupted by the sticker shock of filling up the tank.

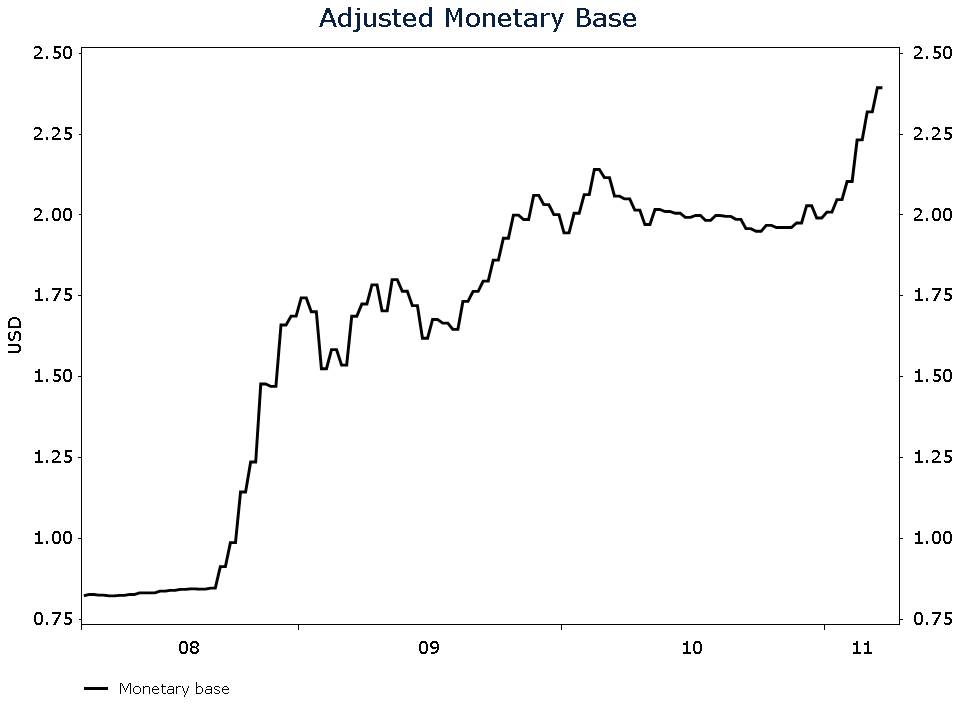

Inflation, pure and simple, is a monetary phenomenon resulting in your dollars losing value. Prices will always be volatile. But if the number of dollars in the marketplace increases because more are created out of thin air, there’s only one result: inflation. And with inflation, your purchasing power goes down, down, down. Look at the following chart. It shows the current monetary base. Do you see what the Federal Reserve is doing? If there are more dollars in the system, do you think they become more valuable or less valuable?

The answer is that your dollar is getting killed. Look how many dollars it costs you to buy an ounce of gold: a record $1,457.70.

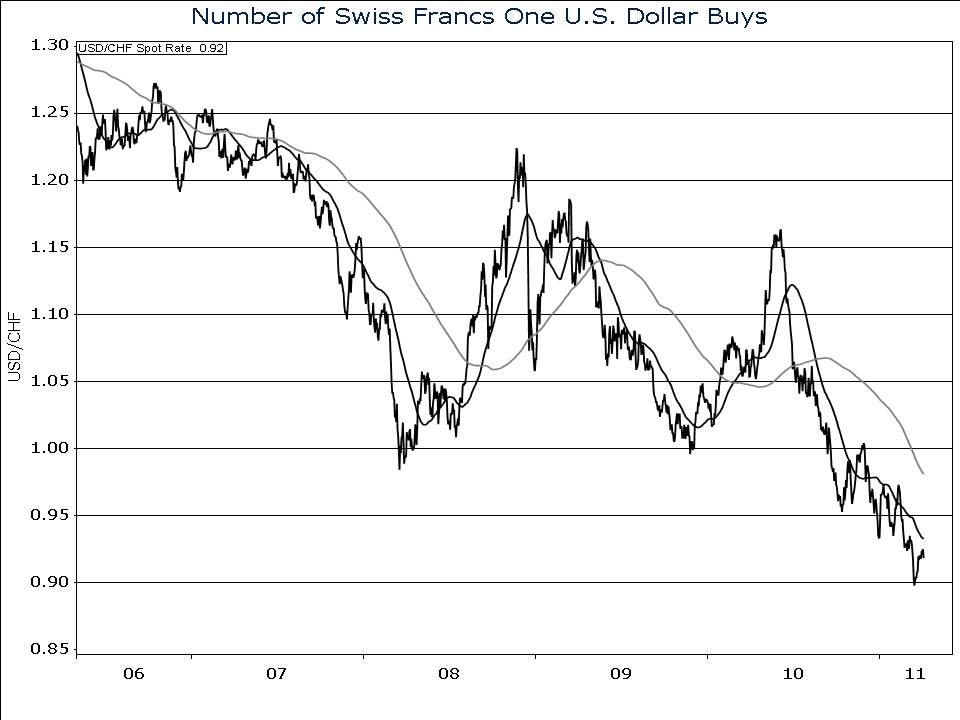

And look at how many Swiss francs you can buy today with a dollar. The decline has been incredible.

Yet, according to the minutes from the recent Federal Reserve meeting, chairman Ben Bernanke feels the rise in global commodity prices is likely to be temporary and shouldn’t translate into a broader inflation problem. Really? Do you trust him to be able to turn this monetary ship around when there is a problem? Fed policy is about as agile as the Titanic.

A minority of Federal Reserve officials are debating the need for rate increases. Minneapolis Fed president Narayana Kocherlakota, for example, said last week that interest rates may need to be increased later this year if underlying inflation rises as anticipated. He said he expects “a big upward movement” in core inflation (excluding food and energy).

I like that Mr. Kocherlakota is one of the few officials warning that rates are too low. I just wish there weren’t so much attention given to core CPI, which is an incomplete measure of prices. Food and energy, excluded by core CPI, happen to be two of the most important things my family consumes daily.

It’s a travesty that the Fed has a dual mandate to maintain low unemployment and stable inflation. Unemployment was 8.8% last month while CPI growth was 2%. The Fed’s short-sightedness on prices while attempting to meet a dual mandate hurts my head to ponder, and hurts your longer-term buying power. An effective approach would be to simply follow a sound monetary policy tied in some way to an unmovable rock—like gold, for example.