You’re right to be concerned about higher interest rates and a decline in bond prices. Yet it would be a shame to miss the boat on the wonderful returns coming from bond funds with short-term maturities. The Vanguard GNMA fund, for example, with an average maturity of less than two years, has returned 7.6% YTD.

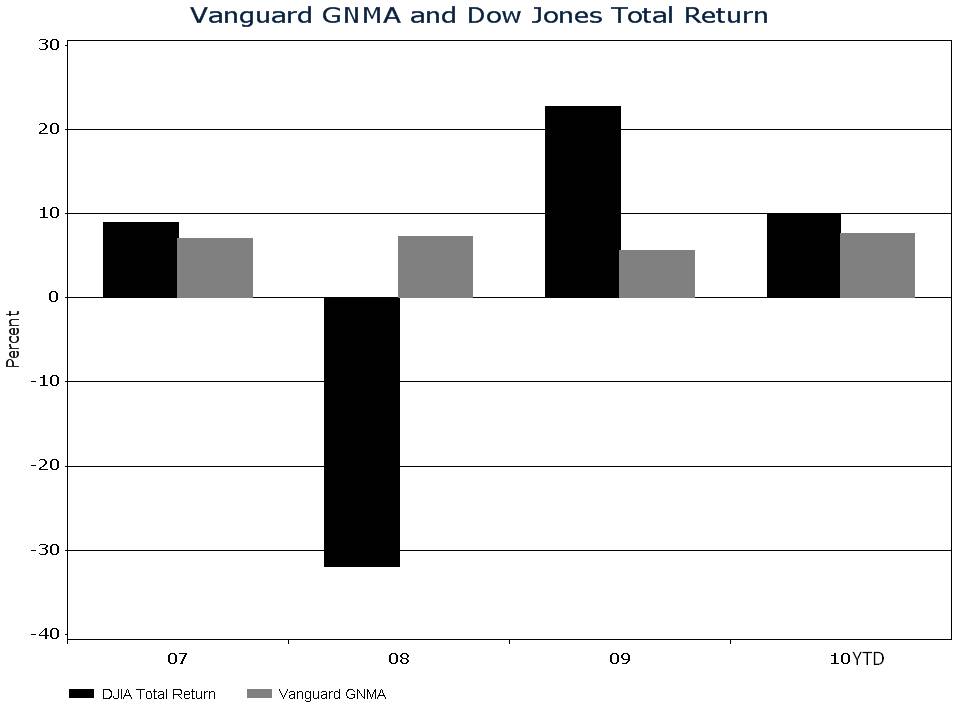

For income investors, GNMA provides a relatively attractive yield of 3.27% compared to other short-term bonds like Treasuries. The Vanguard Short-Term Treasury, for example, yields only 0.30%. And compared to stocks, the Vanguard GNMA fund was up 7.2% in 2008 while the S&P 500 lost 38.6%. That’s an outperformance of 45.8%. Look how smooth the ride has been in GNMA.

What would your portfolio have looked like with a balanced approach? You can run some back-of-the-napkin scenarios by putting a percentage of your portfolio equal to your age in GNMA. This helps you see how including GNMA in your portfolio could lessen the blow when stocks are down. For example, a 65-year-old who put 65% in GNMA and 35% in the S&P 500 would have lost only 8.83% in 2008—and by staying with that mix would already be above 2008 levels today. That has a nice ring to it, don’t you think?

GNMA was up 7.0% in 2007, 7.2% in 2008, and 5.3% in 2009. And for illustrative purposes, let’s assume the year ended with GNMA up 7.6%. If you compound 7%, 7.2%, 5.3%, and 7.6% over four years, that’s an increase of 30%. Don’t make the mistake that many investors do of looking at past performance and just adding up 7%, 7.2%, 5.3%, and 7.6% to get 27%. You’re leaving out interest on interest. In this example, compound interest pays an extra 3% to get you 30%. In the case of GNMA, that’s about a year’s worth of interest for nothing.

If interest rates should go up over the next four years, GNMA’s short-term maturity will help protect you from the declines in bond prices. Its duration, which measures a bond’s sensitivity to interest rates, is only 1.9 years. This means that for every 1% increase in interest rates, the price of GNMA will fall by approximately 1.9%. That’s not unbearable, and the interest payments you receive will help soften the blow as you wait for the fund to invest in higher-yielding bonds. I consider that a price worth the wait.