You’ve been rewarded for sticking with Vanguard GNMA. Over the last 52-weeks it has returned 5 percent and through the first half of this year it is up 4.5 percent.

A lot of investors sold their GNMA last year when the Fed began its taper talk. And at the beginning of this year the so called experts said bonds were dead—making it even harder for you to hang in there. I’m glad you did. Aren’t you?

Still all the chatter is about stocks. This week the Dow and S&P 500 both had record closings. Tech is way overbought and bonds are being left for dead, again. But the prudent investor would be wise to remember October 2007.

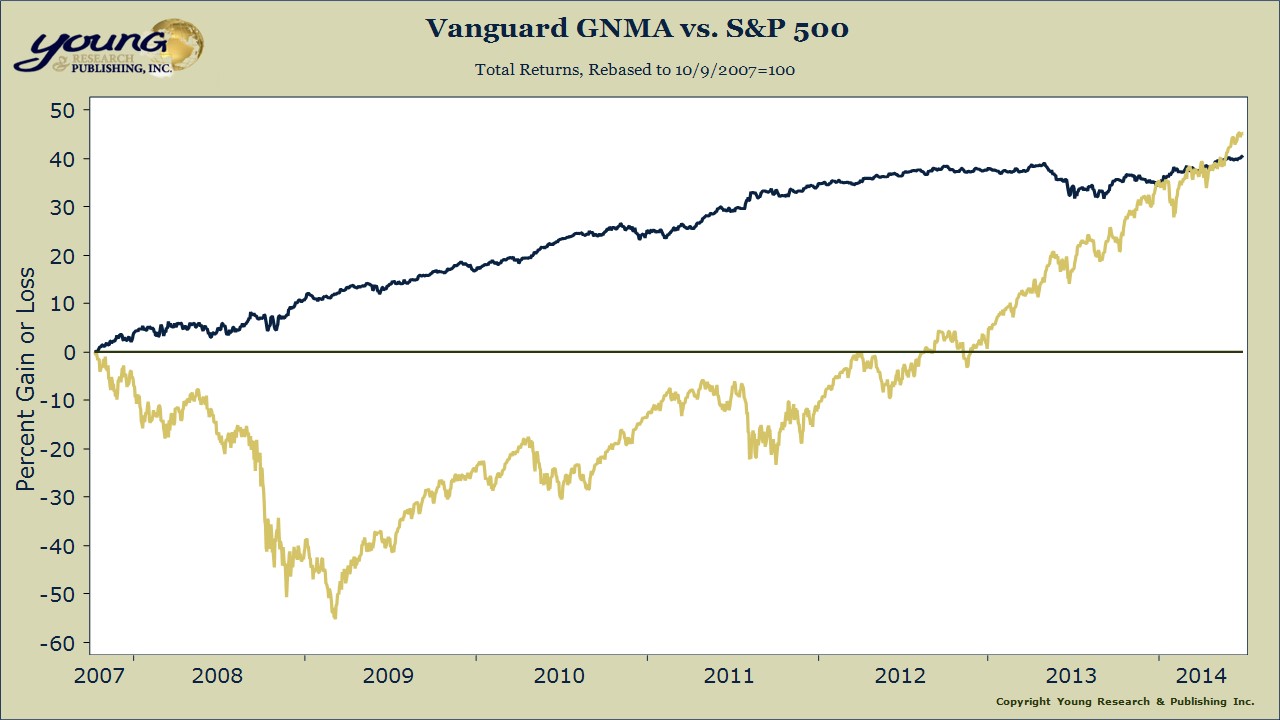

On October 9, 2007 both the Dow and S&P 500 closed at record highs. The Dow was at 14,164. And again bonds were way out of favor. The Dow proceeded to lose over half its value over the following months—GNMA made money.

From October 2007 to now, GNMA is up 40.6% while the S&P 500 is up 45.2%.

With the S&P 500 you would have had to endure almost seven years of heart breaking volatility. And if you were retired you’d be drawing income from stocks at much lower levels.

Instead with GNMA you didn’t lose money, you stayed in the game, and firmed up a base for your portfolio.

You couldn’t ask for anything more from GNMA then or now as a foundation for your retirement portfolio.