If you have a dollar and lose $0.25 you’re left with $0.75. You’ve lost 25% of what you had, but to get back to $1.00, you’ll have to generate 33% of what you have now. To get it back you could go to work or you could hope the market helps you out. In real life when a husband and wife watch their portfolio go from $1 million to $750,000, they get out of the market. It’s too painful to watch. That tends to make their losses even worse because they lose the power of compounding. There’s a better way—it’s counterbalancing.

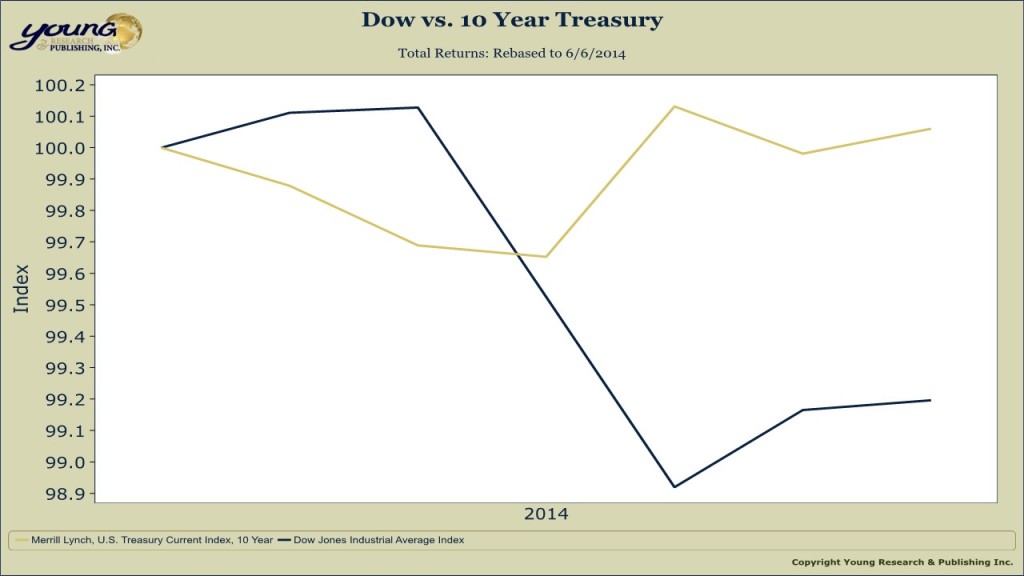

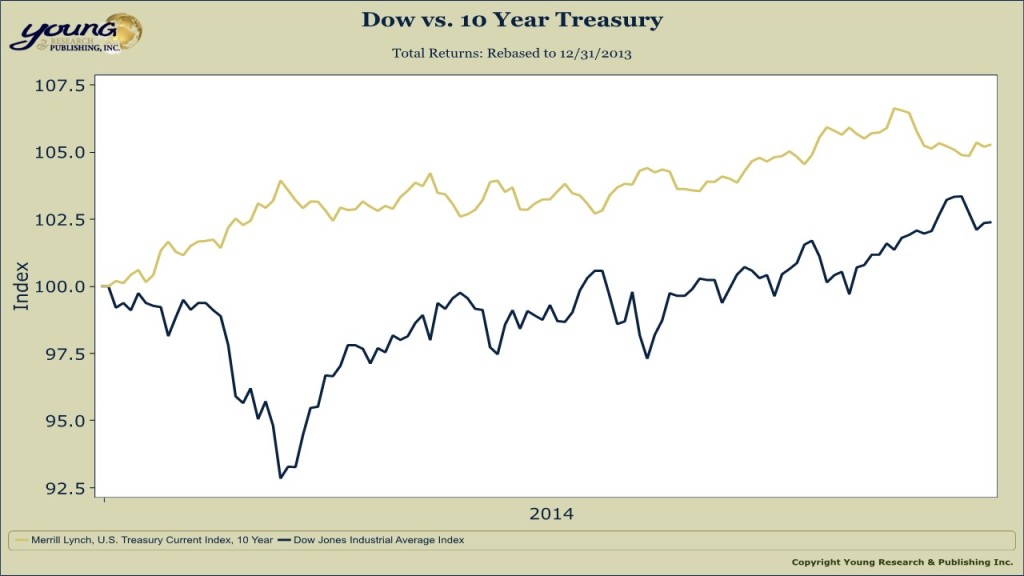

As you can see in the following charts, counterbalancing helps you win by not losing. Last week’s pull back in the stock market was a good week for 10-Year Treasuries. The same is true year-to-date 2014, and again it’s true going all the way back through the real estate crash to before the tech bust. Counterbalancing works. And I expect it to work during the next pull back. Discuss this with your spouse and develop a plan for counterbalancing your portfolio because often these discussions take place only after it’s too late.