Tight global oil supplies and tensions with Iran (among other factors) have pushed retail gasoline prices back above $4 per gallon. When gasoline prices surged to near $4 per gallon last year, economic growth slowed as purchases cut into consumers’ discretionary spending power. Should we expect another downturn in consumer spending now that gas is near $4 per gallon again?

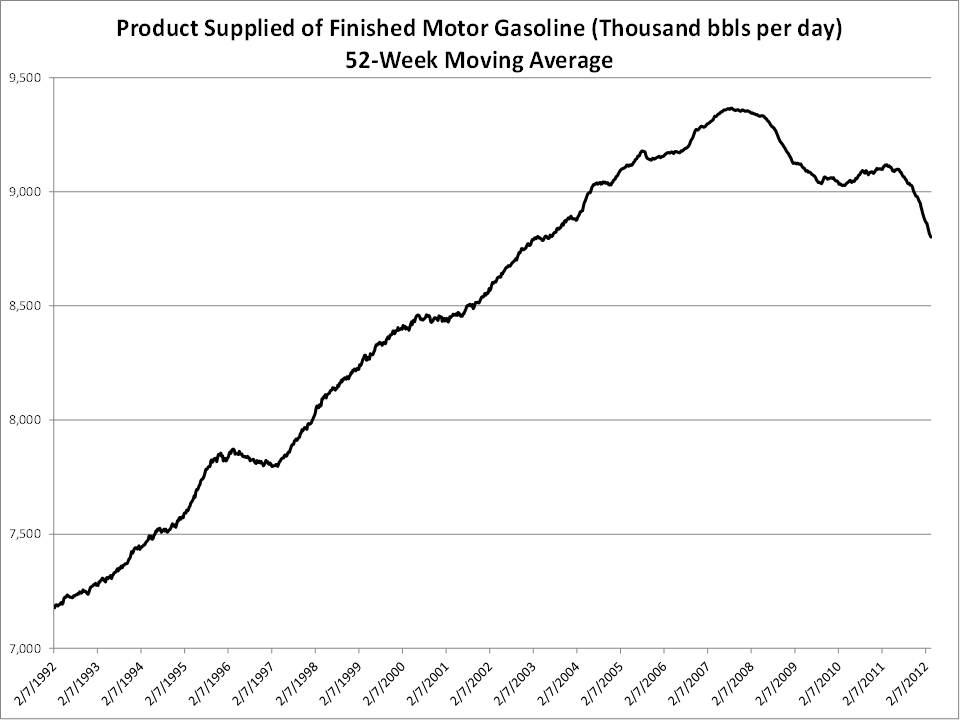

Gasoline prices have only been near $4/gallon for a few weeks, but the evidence suggests lower gasoline consumption (see chart below) and falling utility bills are offsetting the higher cost of gasoline. Over the last year retail gas consumption is down 3.4%—an almost 10 year low, according to the Department of Energy. So even though prices are as high as they were last year, consumers (in the aggregate) are spending less at the pump. Consumers are also spending less to heat their homes and keep the lights on. According to the National Oceanic and Atmospheric Administration, this winter was the fourth warmest on record. Consumers in northern states saved a bundle on home heating costs this year. And multi-year lows in the price of natural gas and coal—the two primary feedstocks at U.S. power plants—have reduced the cost of electricity for millions of Americans.

America cannot withstand a significant decline in consumer spending—the largest part of the economy. Any decline could tip the country back into recession. So far, structural and temporary factors have insulated Americans from the dangerous effect higher gasoline prices could have on their discretionary spending. But it would only take another $0.10-$0.15 sustained increase in the price of gas for consumer spending to slow enough to affect the broader economy. Even a minor shock to the supply chain could cause a crippling increase in the price of gasoline.