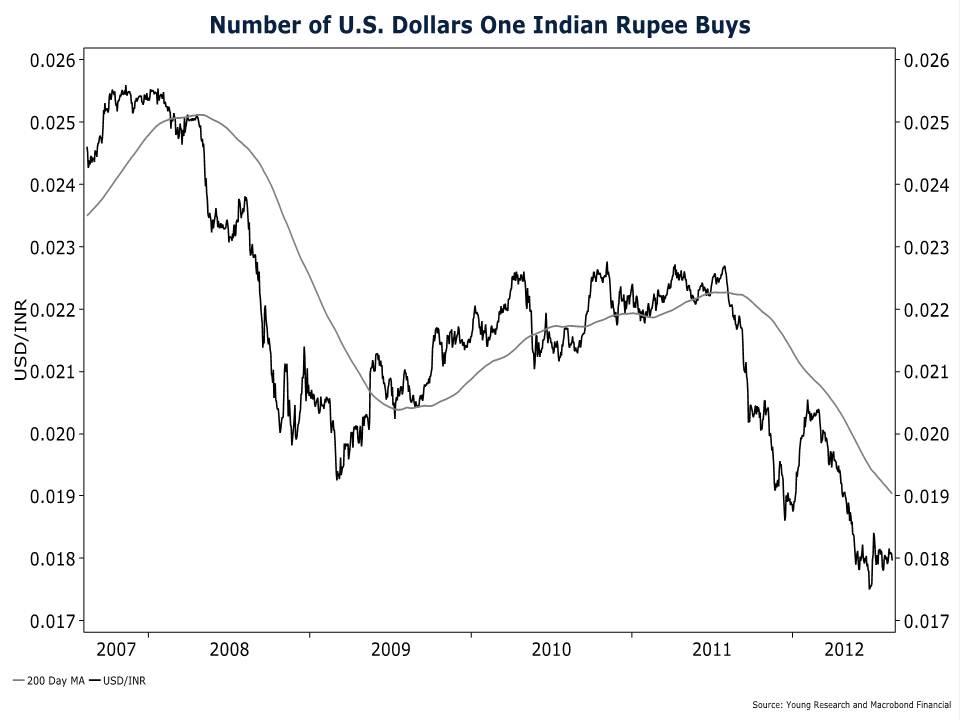

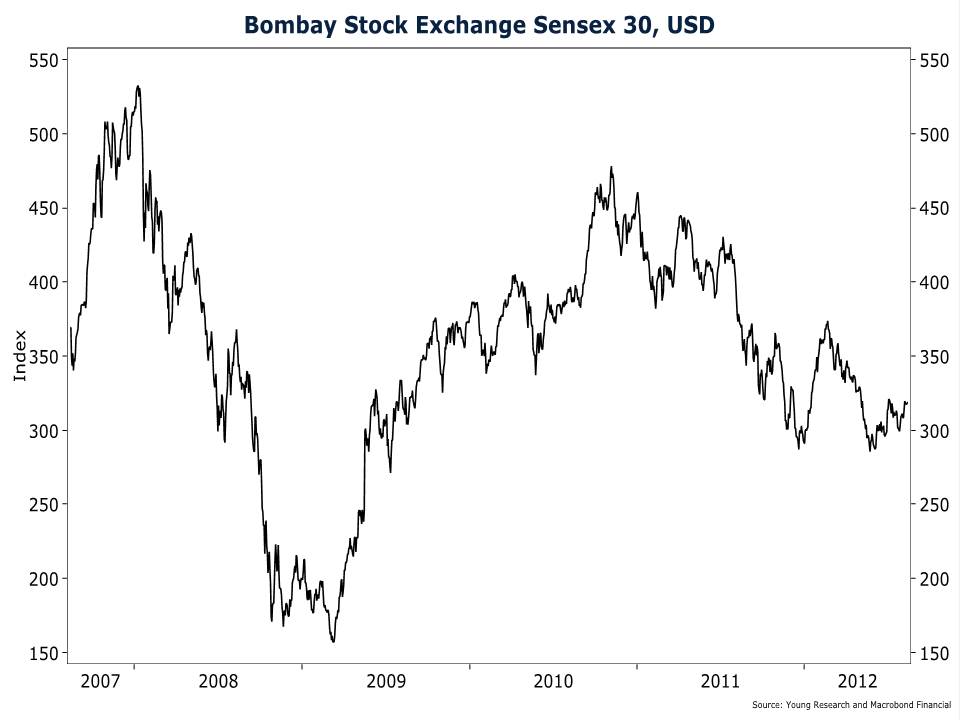

India, one of the much hyped BRIC countries (Brazil, Russia, India and China) has seen its currency plunge in recent months. Over the last 12 months the Indian rupee has lost 20% of its value (chart 1) compared to the U.S. dollar. If you have been one of the unfortunate investors who have owned Indian stocks over the last year, you are down 23% (chart 2).

For much of the last decade the hucksters and promoters on Wall Street have pushed BRIC stocks as a growth story. But what your broker likely failed to mention during his pitch was the currency risk of investing in a country such as India or the political risk of investing in countries such as Russia and China.

There is no doubt that today a properly diversified portfolio is a globally diversified portfolio. Would you be surprised to learn that over 80% of the world’s publicly traded companies are domiciled outside of the U.S.? Think of the opportunities you are missing if you are investing only in domestic shares. If you don’t yet have a globally diversified portfolio, don’t fret. It is never too late to fortify your portfolio. But as a recent investment in Indian shares illustrates, without the guidance of an unbiased advisor (sorry Wall Street) you will be navigating international markets without a compass.