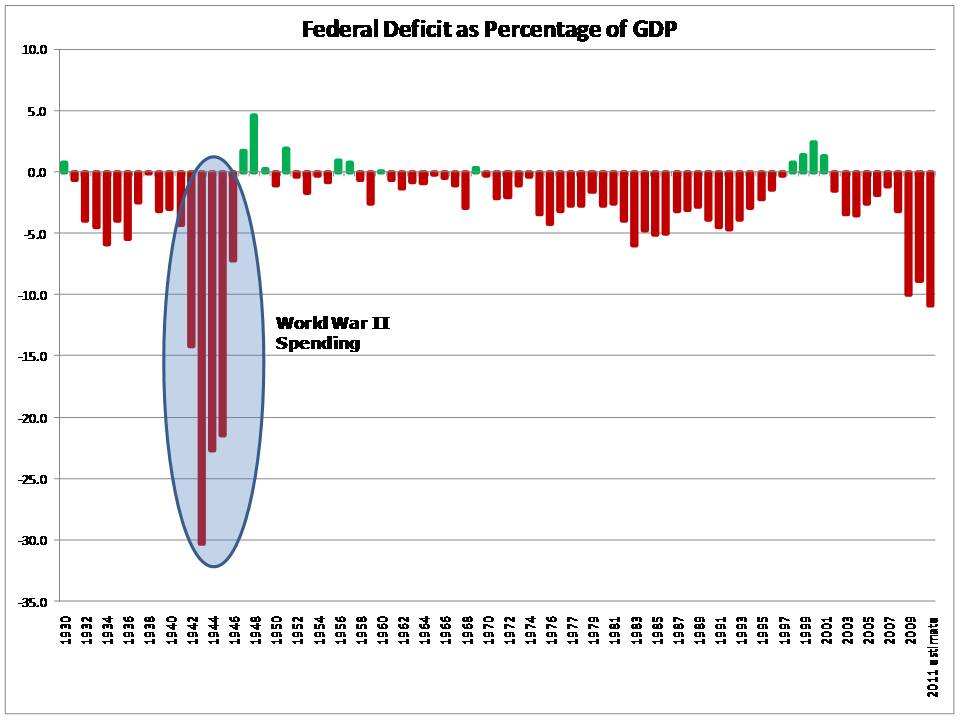

Just in case you needed more evidence of the seriousness of the federal deficit, these two charts provide some historical perspective. The first chart shows the federal deficit as a percentage of GDP since 1930. The deficit as a percentage of GDP is at a post–World War II record. This administration and Congress are running deficits that are twice as high as those run by FDR during the Great Depression. The profligacy is truly staggering.

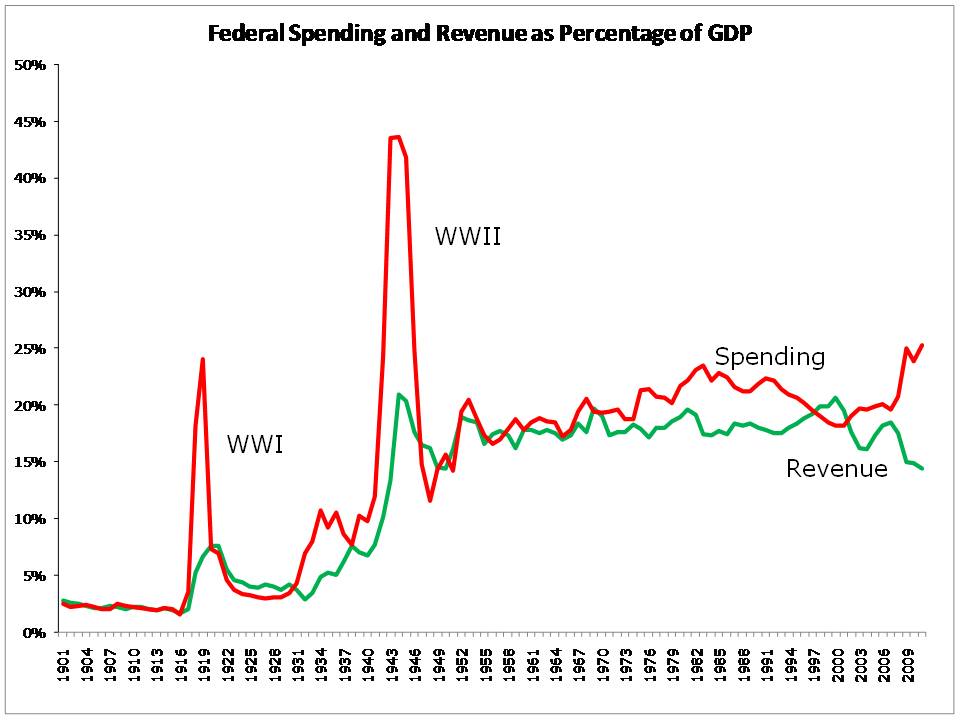

How did we get here? Is the federal government spending too much or taxing too little? Let’s start with revenues. Revenues as a percentage of GDP are clearly down. In fact, federal receipts as a percentage of GDP are the lowest they have been since the 1950s. Some argue that the Bush tax cuts are responsible for the low level of revenues. This is the story line the Obama administration and some in Congress are using to justify proposed tax rate hikes on high-income earners.

But revenues aren’t down because tax rates are too low. Prior to the recession, under the same tax code we have today, the U.S. government collected revenues that were equal to 18% of GDP—slightly more than the post–World War II average. Revenues are down because unemployment is up. There are seven million fewer Americans employed today than were employed prior to the recession. The problem is not a shortage of revenue; it is an excess of spending. In the last three years, federal spending has surged to more than 25% of GDP—the highest on record, not including the World War II years. The only way to credibly reduce the deficit is to cut spending. Those members of Congress who are calling for tax hikes to close the deficit are simply looking for a means to sustain bigger government.