Using a buy and hold strategy to invest in agricultural commodities futures or funds that buy agricultural commodities futures is a loser’s game. Agricultural commodities futures routinely trade in a state of contango. Contago occurs when distant month futures contracts trade at a premium to near month contracts. When a futures contract reaches expiration investors must sell it and buy a contract expiring at a later date. This is called rolling futures. But when a futures market is in a state of contango the near month contract being sold will trade at a lower price than the contract being purchased. Essentially investors are selling low and buying high.

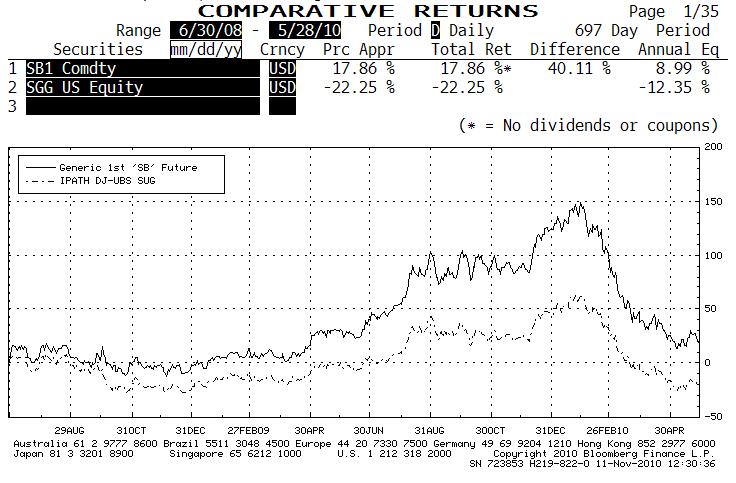

The losses from rolling futures contracts can devastate a commodities portfolio. My chart shows the difference in performance between near-month sugar futures and the iPath Sugar ETN. The near-month futures contract simply tracks the price of sugar, but the iPath ETN includes the losses incurred from rolling futures contracts. Over the last two years, a buy and hold investor would have lost 22.25% in the iPath Sugar ETN compared to a gain of 17.86% in sugar prices. The iPath fund underperformed the commodity it was supposed to track by more than 40%. Buy and hold in agricultural commodities futures is undoubtedly a losing strategy.

The agricultural commodities sector offers the astute investor profound promise over coming decades, but to profit the right strategy must be used. In Young Research’s Global Investment Strategy we arm investors with the necessary intelligence to profit from agricultural commodities. If you’re not yet a subscriber, please join us.