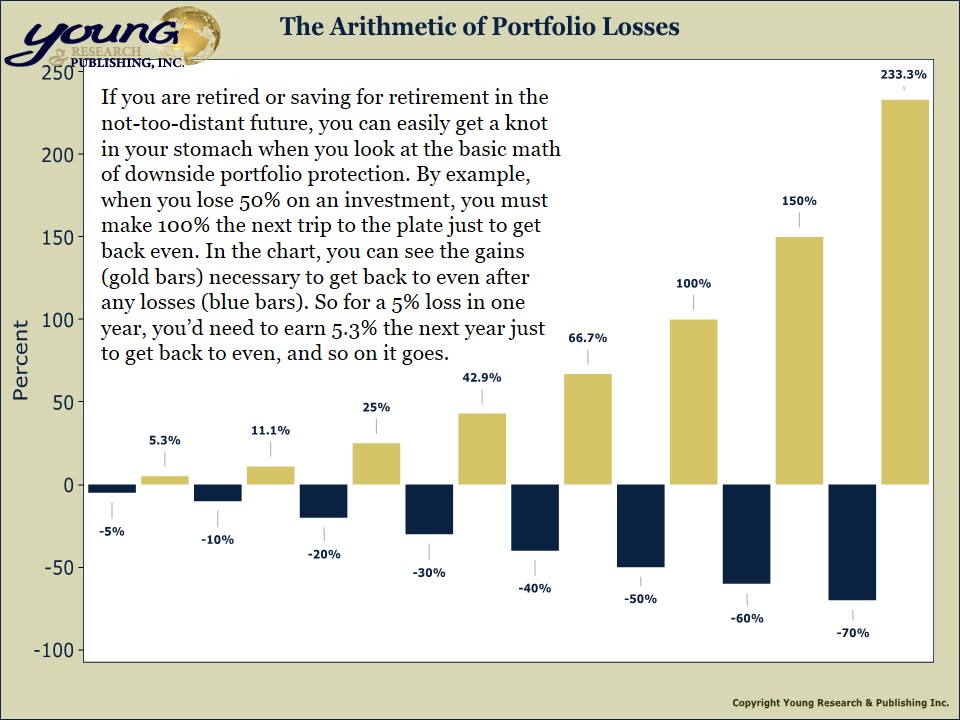

It’s impossible to have it all ways. In order to craft an investment portfolio that can act as an all-weather armadillo, you must be willing to forgo potentially substantial upside rewards to balance against the horror of a downside wipeout. If you are retired or saving for retirement in the not-too-distant future, you can easily get a knot in your stomach when you look at the basic math of downside portfolio protection.

By example, when you lose 50% on an investment, you must make 100% the next trip to the plate just to get back even. And that’s without considering the negative drag of expenses and taxes on your gain as well as the fact that you’ll have to overcome the income you pull from your portfolio to meet your income needs. Things can get real ugly—and fast. For a big percentage of investors, the mindset to take a deliberate and laser-focused armadillo-like approach is never achieved. For this unfortunate crowd, the ticking time bomb has already been set. What awaits is the explosion and ensuing financial carnage for the sad family.