With much of the investment world focused on geopolitical events in Europe and the Middle East and how much or how little money the Fed and the European Central Bank are going to print, China seems to have fallen off of the radar.

It shouldn’t.

China is a major player in the global economy. It is the world’s second largest economy and the world’s fastest growing large economy. China sucks up a majority of the world’s resources. It is the largest consumer of aluminum, copper, cotton, and coal just to name a few.

If the Chinese economy craters, the world will feel the pain and if it booms, global growth will get a boost.

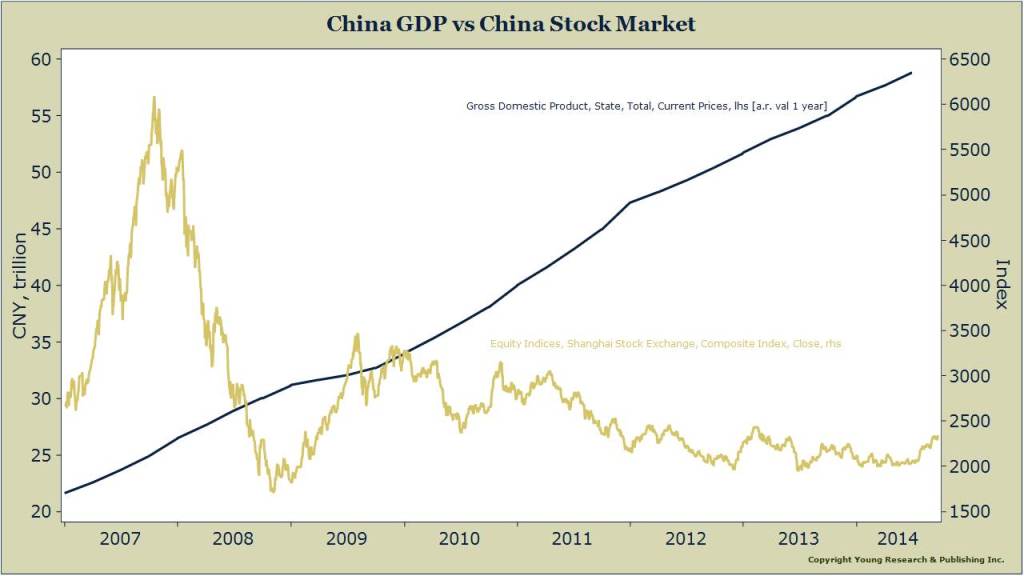

So when I see a chart like the chart below I get concerned. And so should you. The chart compares the performance of Chinese stocks as measured by the Shanghai Composite Index to the performance of China’s Gross Domestic Product.

Over the last eight years, China’s GDP has increased by a factor of almost three, while the country’s stock market has actually lost ground.

How could that be?

Have investors in Chinese companies not noticed that China is producing three times what it did eight years ago?

I doubt it. The more logical conclusion is that China’s economic data is suspect (a strong probability) or the quality of China’s economic growth is shaky (an even stronger probability).

At some point we should see the gap between China’s GDP and its stock market close. It may close in a benign fashion with Chinese shares soaring to catch up to GDP, but such a scenario assumes that Chinese stocks are the biggest bargain that nobody has heard of. With trillions in excess liquidity sloshing around the global financial system somehow that doesn’t seem credible.

The alternative scenario is that the folk who are putting capital at risk in Chinese shares have the better read on China’s economy. If this is true, the Chinese economy as well as the global economy are at risk.

Today, the evidence is leaning more toward the alternative scenario than the benign scenario. Cracks in the facade of China’s robust economic growth are starting to show. To cite just one example, the Wall Street Journal recently reported that the supply of unsold residential property in China rose to its highest level on record, despite substantial price cuts by developers and moves by local governments across China to make buying homes easier.

Calibrate your investment strategy accordingly. If you need help navigating the global investment landscape, be sure to check out our premium strategy reports.