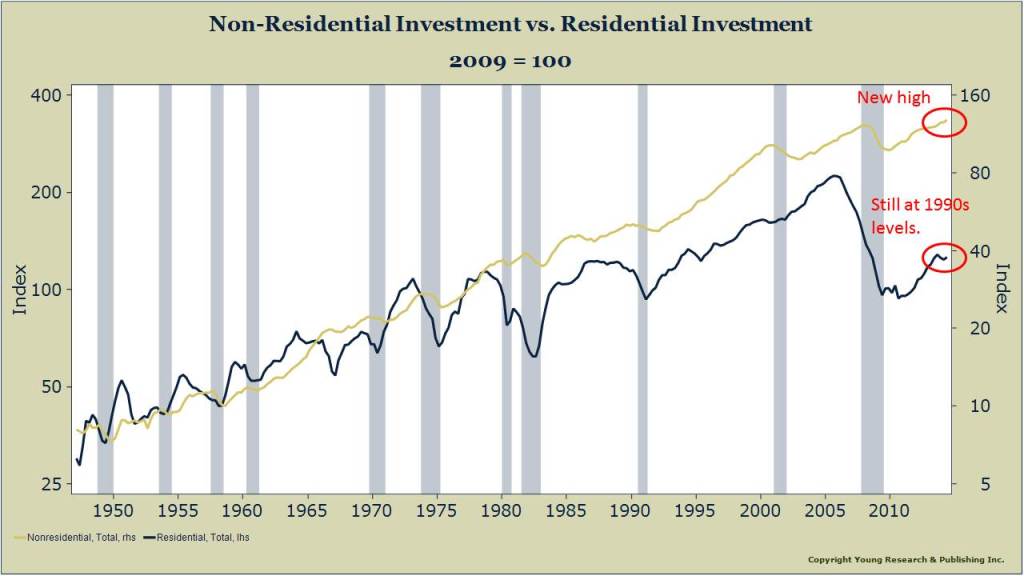

One of the reasons this business cycle recovery has been one of the weakest on record is that it hasn’t been firing on all cylinders. The weak link among the cyclical sectors of the economy has been residential fixed investment. While there has been some recovery from the dark days of the financial crisis, adjusted for inflation, residential investment is no higher than it was 20 years ago. Non-residential fixed investment, which is made up of business investment in factories, equipment and intellectual property has already hit a new high.

With the housing market looking more like it is cooling down than heating up, residential fixed investment is not an engine that should be counted on to speed up the pace of recovery.