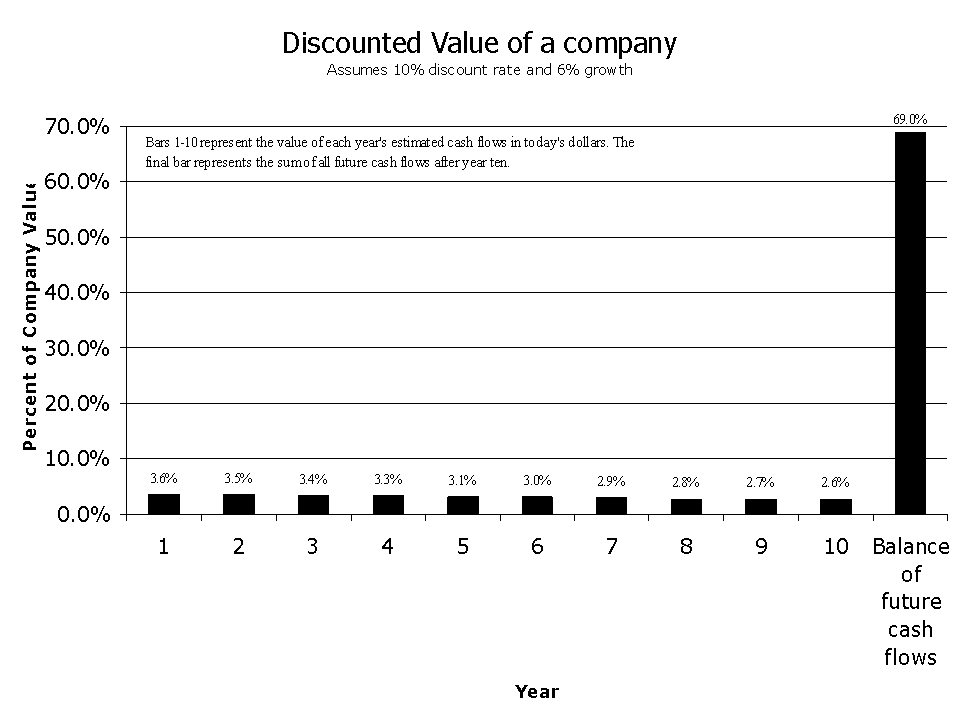

Stocks are assets. The true value of any asset is simply the discounted value of all future cash flows. This holds true for stocks, bonds, property, natural resources, and even collectibles. To calculate the value of an asset you simply estimate all future cash flows and discount them at an appropriate rate. When you go through this exercise for a company you quickly realize that the value of any individual year’s worth of cash flows accounts for a relatively small portion of that company’s value. The majority of a company’s value is determined by adding up discounted cash flows far into the future. Chart 1 shows cash flow as a percentage of total company value for a firm growing at 6% annually assuming a 10% discount rate.

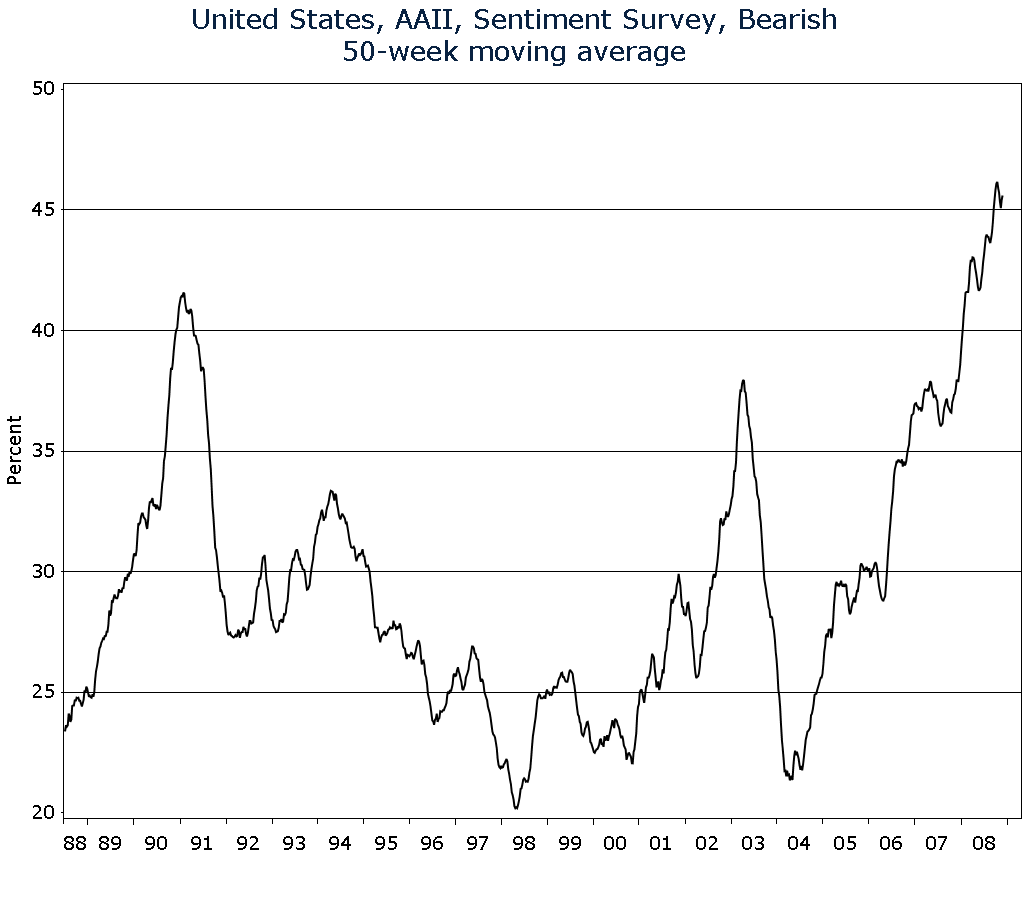

A year or two of dismal cash flows impacts the value of a company to a much smaller degree than one would expect based on share price fluctuations. Even if we are entering a deep and prolonged recession that wipes out all cash flows on the S&P 500 in both 2009 and 2010, the intrinsic value of the index would only decline about 7%. But the S&P 500 is down 40% year to date. The difference between the drop in price and value can be explained by a change in the discount rate. The discount rate is made up of an interest component and a risk premium for owning stocks versus treasuries. The risk premium is determined mostly by investor sentiment. When investors are fearful they demand a greater return (higher discount rate) to buy stocks and when they are greedy (lower discount rate) they demand a lower return. When investor sentiment falls, the discount rate rises and stock prices fall. Today, bearish sentiment is at its worst level on record (Chart 2).

As a result, stock prices have fallen much more than they should have based only on the prospect of lower cash flows. Moving forward, a higher risk premium indicates higher future returns. And higher future returns are already indicated by the dividend yield on the S&P 500 which is approaching multi-decade highs. When you fully grasp the fact that the wild fluctuations in stock prices are due much more to volatile, unpredictable, and reversible investor sentiment, 500 point swings in the Dow and gloom and doom from the financial media are far less worrisome.