Yesterday the Census Bureau released the September report on the number of Housing Starts and Building Permits. Both increased much more than expected—permits surged by 11.6%, and starts were up by 15%.

After trudging along a Derpressionary bottom for more than three years, it is now safe to say that housing activity is finally picking up (prices may be a different story). But don’t get too excited. Despite the most accommodative monetary policy in the history of the republic, the 15% surge in starts only moves us from Depressionary levels to recessionary levels. Housing will of course eventually recover, population growth assures us of that, but there are still many headwinds.

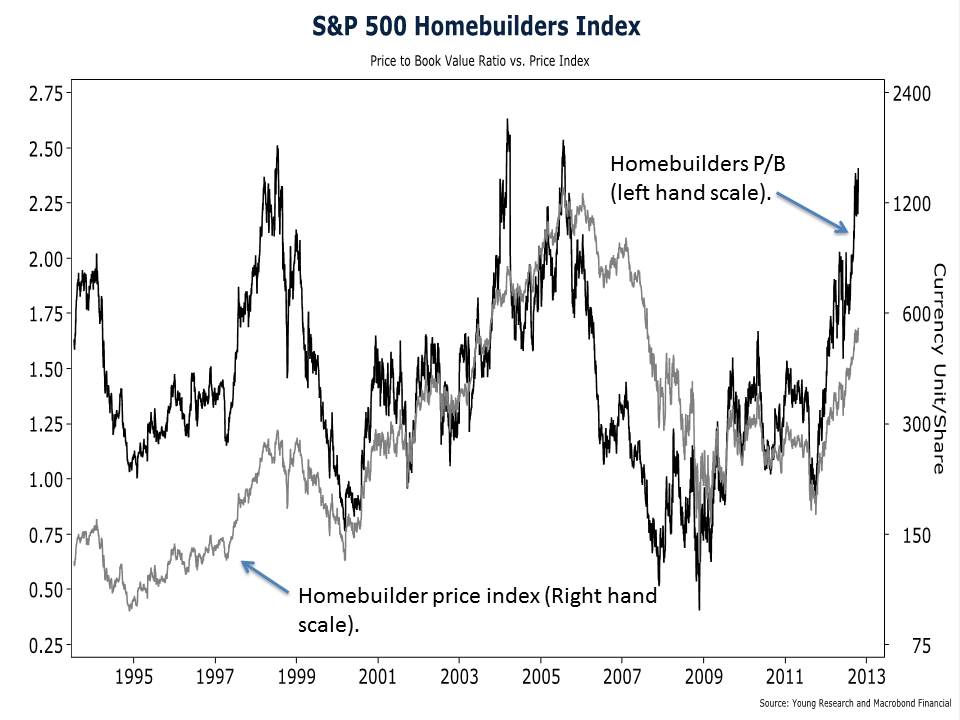

Unfortunately that message hasn’t gotten through to some in the investing public. The folk loading up on homebuilding stocks think real estate is headed straight back to the bubble days of yore. The S&P 500 homebuilding index has more than doubled YTD. The current price-to-book value ratio of the S&P 500 homebuilders index is well above 2.25. That’s a lofty valuation for an industry with such lousy economics. Homebuilders don’t offer a competitive advantage. There are no significant barriers to entry in the business. All you need is capital and a construction crew and you too can start a homebuilding business.

What is most confounding about bubble-era valuations in homebuilder stocks is that, the vast majority of their assets are just property. Why buy property in the stock market at twice its cost in the real estate market? Sounds like a hard way to make money.

And historically it has been. On the last two occasions homebuilders’ valuations reached such stratospheric levels, the S&P 500 homebuilding index crashed hard in subsequent years. I’m not trying to make a forecast here. Homebuilder stocks may still have some room to run in the short-term, but given the bubble-era valuations, this is an industry best left to traders and speculators.