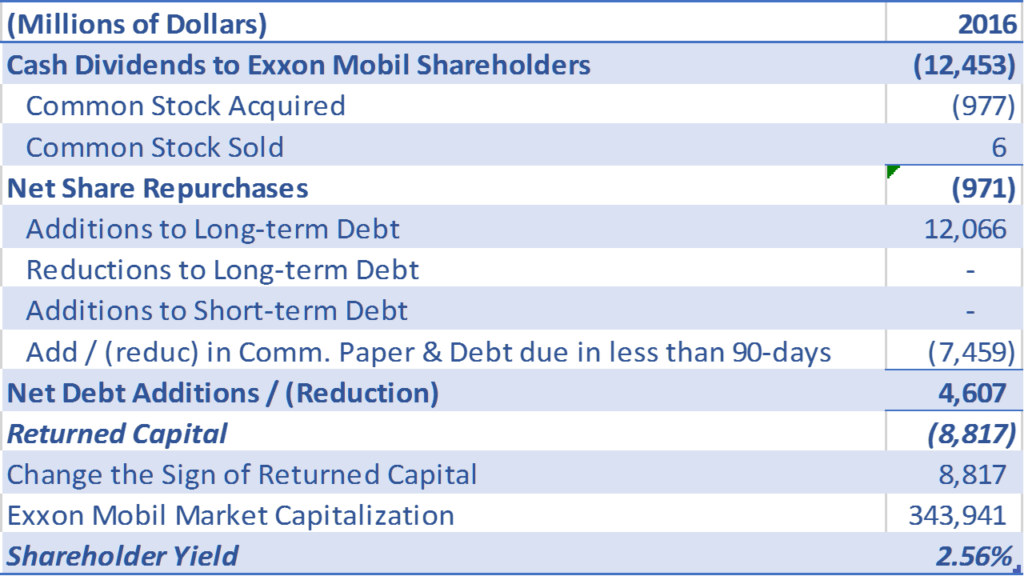

To calculate the shareholder yield, pick up the annual report for a company you are interested in (preferably a non-financial company), and turn to the Statement of Cash Flows. In the Statement of Cash Flows, move down to the section labeled – Cash Flows from Financing Activities. For most companies, this is the last section of the Cash Flow Statement. To calculate shareholder yield, you have to determine the total amount of dividends that were paid to shareholders, the net amount of stock that was repurchased, and the net amount of debt that was repaid. Before you get started, remember you are dealing with a cash flow statement so cash outflows, such as dividends, are recorded as negative numbers.

Dividends are usually the easiest component of shareholder yield to find. Look for an entry labeled dividends. Jot this number down and label it, well…dividends. Next you want to find the dollar amount of stock repurchased and the dollar amount of stock issued. Add the two numbers together, label it net share repurchases, and jot it down under the dividends number you recorded previously. The last component of shareholder yield is debt repayment. You are looking for net debt repayment so you want to sum all long-term and short-term debt issuance and repayment. Once you calculate net debt reduction, add dividends and net share buybacks calculated earlier, and label this number returned capital. Before you calculate shareholder yield, change the sign of returned capital. Remember, we are dealing with the cash flow statement so negative numbers are flows out of the company’s coffers to you. Shareholder yield is simply equal to returned capital divided by market capitalization. You can find the market capitalization of a company at Yahoo! finance.

Below we illustrate our shareholder yield calculation for Exxon Mobil.