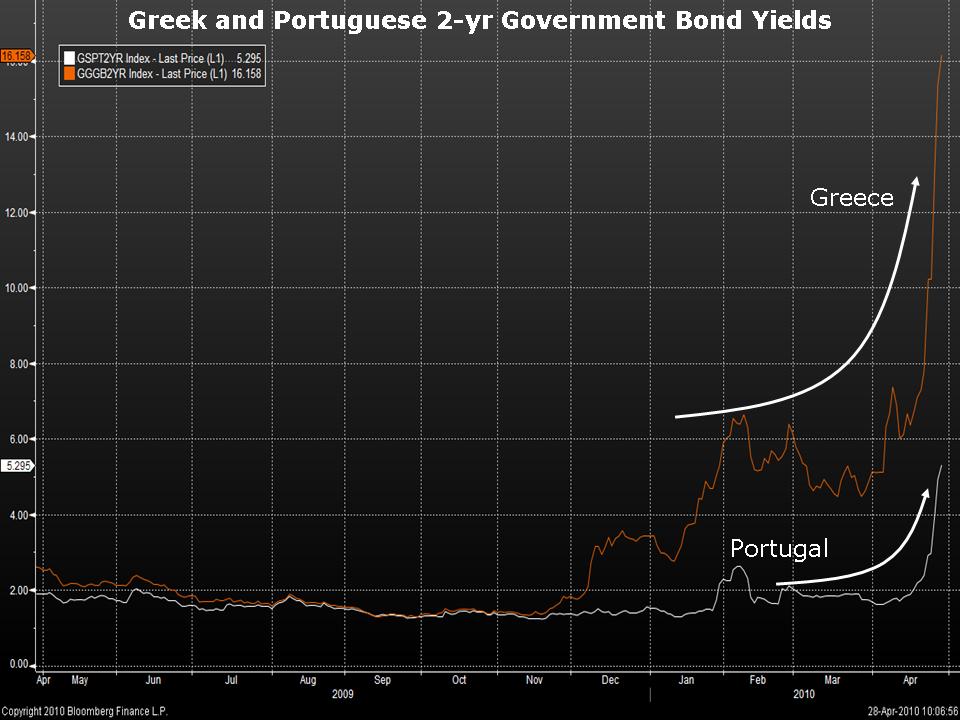

Greek government bond yields have surged to over 16% in recent days. If Germany doesn’t step into to save the Greeks, a default is not out of the question. But the larger problems for Europe are the risk of contagion. Bond yields on other overly indebted euro-area countries are now surging. Portugal is the market’s next target. Yields on short government debt have surged 230 basis points in a matter of weeks.

You Might Also Like:

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023