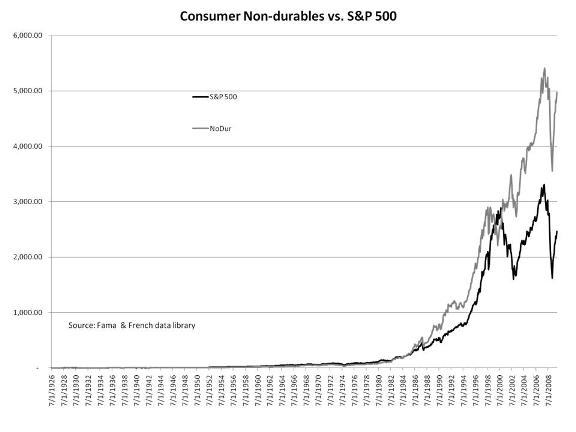

My chart shows the long-term performance of $1 invested in the consumer non-durables sector in June of 1926 to $1 invested in the S&P 500 at the same time. The consumer non-durables industry includes companies that make and sell everyday items. Demand for non-durables, or what are more commonly referred to as consumer staples, is not heavily influenced by the business cycle. You don’t stop eating or brushing your teeth just because the economy is in recession. The consistency and stability of consumer staples companies definitely appeals to investors in or nearing retirement, but all investors should consider these stocks. Consumer staples have outperformed the S&P 500 by a margin of more than two to one over the last 8 ½ decades. Investors writing off this sector of the market are potentially forgoing one of the most profitable opportunities in the stock market.

Richard C. Young is the editor of Young's World Money Forecast, and a contributing editor to both Richardcyoung.com and Youngresearch.com.

Latest posts by Dick Young (see all)

- A Conflict of Interest: True Costs of Investing in Energy Transition - April 19, 2024

- China’s Slowing Property Market Fuels Surplus of Steel - April 19, 2024

- US Plans to Restore Solar Tariffs - April 18, 2024