This story doesn’t have a happy ending. You see this often in the late stages of a bull market. After missing the bulk of the rally in the stock market from the prior bear market lows, the general investing public gets greedy. Those investors who couldn’t find a thing to like about the investment climate become the biggest cheerleaders for a permanent prosperity. The regret of missing most of the bull market gains pushes many to make up for lost time by getting too aggressive. Stocks with questionable business prospects that most wouldn’t touch during the prior bear market become the most widely held. The pundits and promoters fuel the fire by assuring investors that the market can only move higher from here.

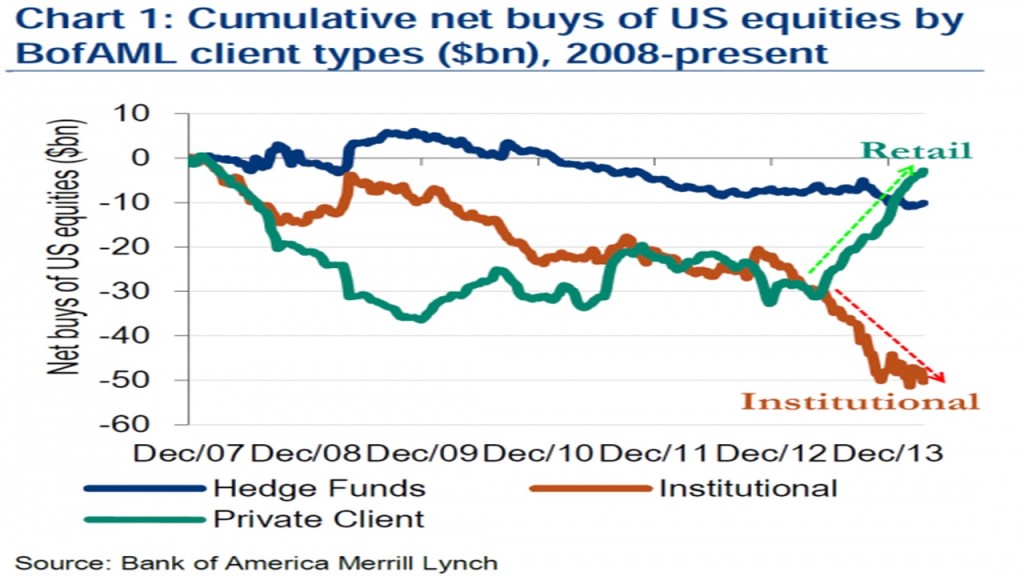

According to data from Bank of America Merrill Lynch, the Wall Street promotion machine, aided and abetted by unprecedented global monetary stimulus, has now gained a foothold with the investing public. Retail investors are pouring money into the market at the fastest pace in years. But retail investors can’t pour money into the market without somebody else pulling money out of the market. So who is selling what the retail investing public is buying? That would be institutional investors and hedge funds.

There is a famous poker quote that has application here. “If, after the first twenty minutes, you don’t know who the sucker at the table is, it’s you.”

Don’t get suckered into to making an emotionally charged investment decision that you will later regret. The wreckage from such a decision can be both financially and mentally difficult to recover from.

At Young Research, we have long advised investors to take a balanced approach. Not because it offers the highest prospective returns, but because it offers investors comfort and helps them stay the course during periods of market turbulence. In the end, it is the investor with discipline and patience that is most successful. Not the investor with the most money invested in stocks.