Should you have more invested in the stock market? The Dow has almost doubled from its March 2009 low. And over the last ten months, the index has gained 26%. Oil prices have started to pull back, the euro-area debt crisis is being addressed (at least temporarily) and some U.S. economic data has come in ahead of expectations. With the Dow surging 5% in only five trading days, you may be feeling more confident. Instead of hoarding cash, you might be looking to invest. But after the near doubling in the stock market, is it still a good time to invest? How can you tell?

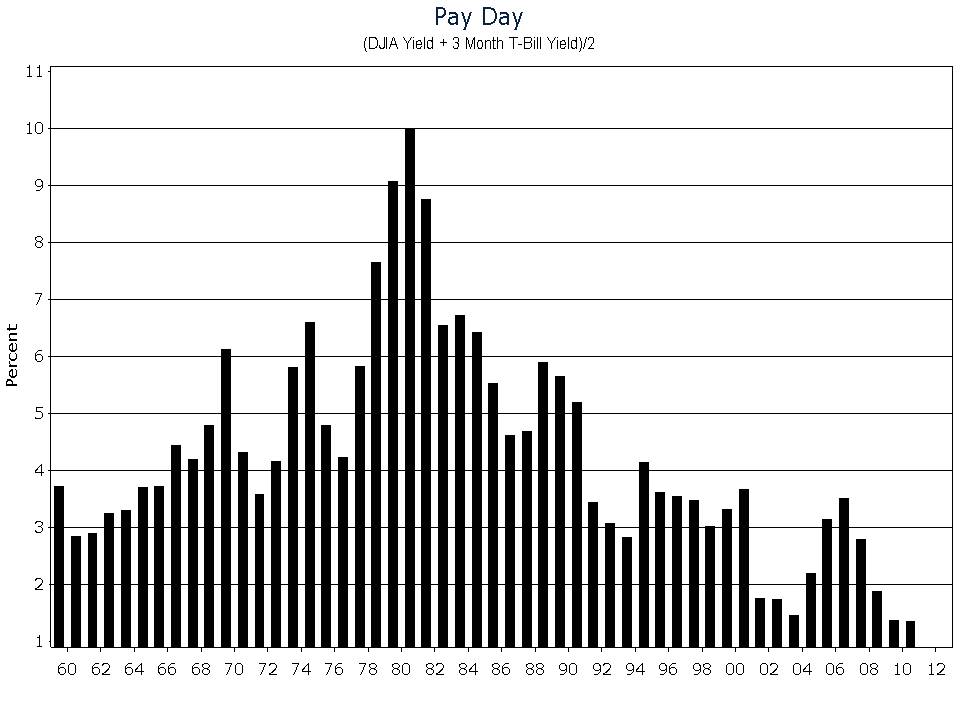

In order to gauge the investment climate, at Young Research, we use a back-of-the-envelope guide that Dick developed over four decades. It is called the Payday Indicator. You don’t need to be an economics wizard or have the ability to decipher cryptic Federal Reserve policy statements to use the indicator. To calculate the Payday Indicator you need no more space than the back of a postage stamp. Simply add the dividend yield on the Dow Jones Industrial Average to the three-month T-bill yield and divide by two. The result is the yield you are paid to invest in a hypothetical portfolio split evenly between blue-chip stocks and risk-free T-bills.

The higher the reading on the Payday Indicator, the better the investment climate and vice versa. High readings offer investors at least two benefits. The first should be obvious: the higher the yields on the Dow and T-bills, the more you get paid to invest. Your focus here should be risk versus reward. The lower the yield, the greater the risk and the smaller the potential reward. The second benefit is that high readings on the Payday Indicator leave room for subsequent declines. Remember, the Payday Indicator is simply an average of the yield on T-bills and the Dow. When T-bill yields fall, stock and bond prices usually rise. Similarly, when dividend yields fall, stock prices rise. If the yield on a stock falls from 5% to 4%, everything else equal, its price should rise 25%.

What does the Payday Indicator say about the investment climate today? The yield on three-month T-bills is two basis points. That is two hundredths of a percent. Sound OK to you? Stocks don’t offer much more in the way of yield either. Today, you are paid only 2.39% to invest in the Dow. Add the two together and divide by two, and you get 1.21%. That’s a record low. The long-term average reading on the Payday Indicator is 4%. Today’s 1.21% reading is miles away from 4%. At the current Dow dividend yield, it would take a T-bill yield of 5.62% to get to a 4% Payday reading.

What’s more, when the Payday Indicator has fallen below 2.7% (bottom quintile), historically the subsequent three-year return on the Dow (excluding dividends) averages only 2%. I am not making a forecast here. I am simply relaying what the data show. Low yields often result in low subsequent returns.

You may wonder how capital appreciation factors in. Even though the Payday Indicator is at a record low, couldn’t future capital appreciation offset low yields? Indeed it could, but conservative investors, should focus on dividends and interest and let capital appreciation come as it may. Anything else is speculative.

Today, the record-low reading on the Payday Indicator tells you that the investment climate stinks. Investors are not being paid well to take risk. It is just that simple.