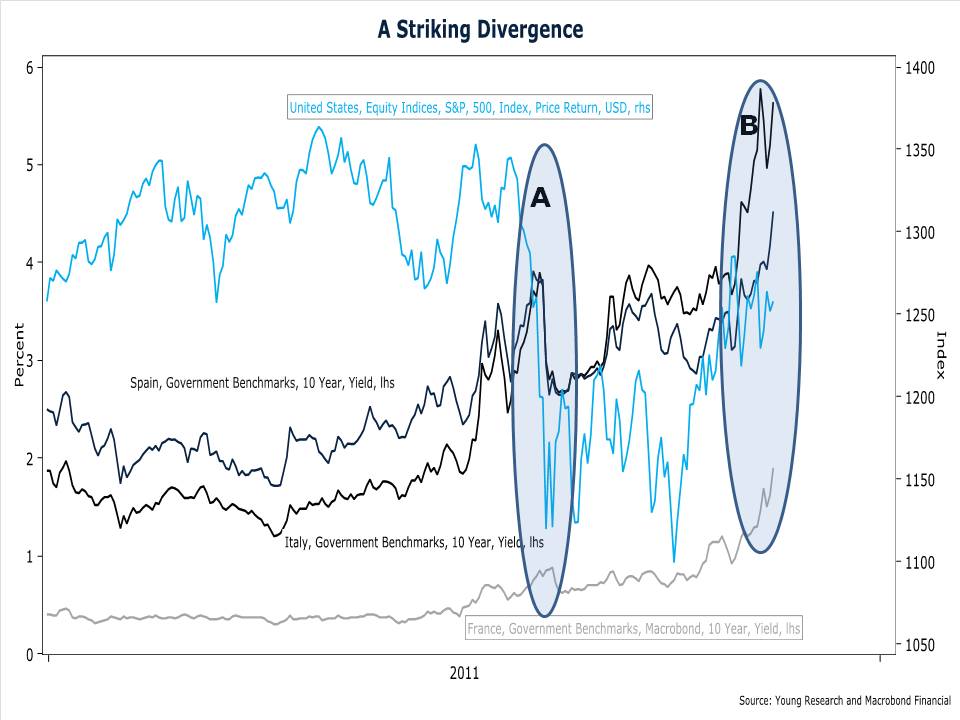

A striking divergence has emerged in global financial markets in recent weeks. During July and August as the euro-area sovereign debt crisis intensified and spreads on Spanish, Italian, and even French bonds rose, U.S. stocks plunged (point A on chart). After the European Central Bank restarted their bond buying program in early August to temporarily take the heat off of Italy and Spain, bond spreads fell. Spreads didn’t rise back to their August highs until late September. The move back up in Spanish and Italian spreads in September contributed to another down-leg in U.S. stocks. That down-leg ended with a powerful early October reversal that carried the S&P 500 to a more than 10% gain for the month. But the optimistic tone in stock prices didn’t carry through to euro-area bond markets. Since mid-October, spreads on Italian, Spanish and (most disturbingly) French bonds have blown out to record highs (Point B), yet U.S. stocks have remained impressively resilient. Is this decoupling sustainable? Maybe, but more than likely the euro-area bond market is too pessimistic or the U.S. stock market is too optimistic. Stay tuned.