The US Energy Information Administration reports that while sales of electric vehicles (EVs) grew earlier in 2025, overall EV sales declined during the year after federal tax credits expired in September. At the same time, hybrid vehicle sales continued to rise, leading hybrids to capture a larger share of the light‑duty vehicle market. The shift affects energy demand patterns because EVs draw grid electricity directly, whereas hybrids rely primarily on gasoline and do not increase electricity consumption. The analysis highlights how changes in policy incentives can influence the composition of new vehicle sales and, by extension, demand for electricity and liquid fuels in the transportation sector. The EIA writes:

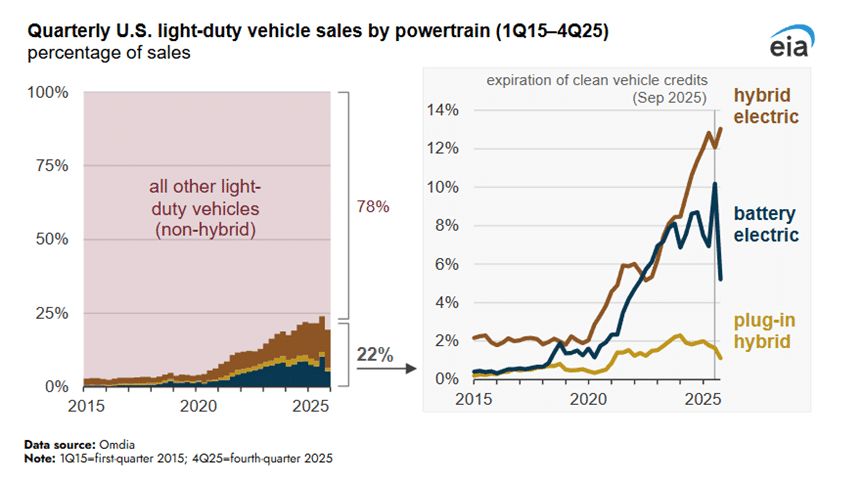

About 22% of light-duty vehicles sold in 2025 in the United States were hybrid, battery electric, or plug-in hybrid vehicles, up from 20% in 2024. Among those categories, hybrid electric vehicles have continued to gain market share while battery electric vehicles and plug-in hybrid vehicles decreased, according to estimates from Omdia. In the second half of 2025, battery electric vehicle sales increased before sharply declining in response to the expiration of tax credits at the end of September.

These different vehicle types affect the broader energy sector in different ways. Battery electric vehicles and plug-in hybrid vehicles can consume electricity from isolated power sources or, more commonly, from the grid. So, their use can affect electricity demand. By comparison, hybrid electric vehicles do not have plugs, so they don’t directly affect grid-delivered electricity demand and were not eligible for any of the federal tax credits that expired in September.

Two tax credits for purchasing or leasing new electric vehicles both expired on September 30, 2025: the New Clean Vehicle Credit and the Qualified Commercial Clean Vehicle Credit. Battery electric vehicle market share reached record highs immediately before the credits expired: 12% of light-duty vehicles sold in September. Battery electric vehicle sales then fell to less than 6% of the market in each of the remaining months of 2025. Last year marked the first year where annual sales and market share of battery electric vehicles declined.

Battery electric vehicle sales in particular are more common in the luxury vehicle market. U.S. luxury vehicles accounted for 14% of the total light-duty vehicle market in 2025, and within luxury sales, battery electric vehicles accounted for 23%. The expiration of the clean vehicle tax credits affected sales of luxury and non-luxury battery electric vehicles in similar ways.

CHART

Because sales figures in any year are relatively small compared with the total number of vehicles on the road, electric vehicles’ share of the total light-duty vehicle fleet is much less than the recent 9% sales share (7.5% battery electric vehicles and 1.6% plug-in hybrids). In our Monthly Energy Review, we maintain annual data series on light-duty vehicles, battery electric vehicles, plug-in hybrid vehicles, and hydrogen fuel cell electric vehicles based on data from S&P Global. In 2024, the most recent data year, electric vehicles accounted for 2% of all registered light-duty vehicles in the United States.

Read more here.