OK, blue-states are drowning in pension debt that may or may not be paid—think Illinois. And yet these cities and states are issuing more debt in the form of municipal bonds. Is that good or bad for investors? Last year the S&P Municipal Bond Index was up 1.76%, but when you dig into the guts of it, there are plenty of reasons, at least for me, to be concerned.

Number one on my list is the average duration of the fund—with its 212,627 constituents—is 12.13 years. This isn’t covered in the article I quote below, but it’s a major factor in the fund’s future performance if interest rates go up. The modified duration of this beast is 4.53 years, meaning that as interest rates have stayed low, municipalities retired debt and issued new bonds. But what if interest rates go up?

Much like a home mortgage where refinancing occurs when rates fall, the same is true with municipal bonds. But what happens if rates don’t fall, and perhaps instead, they increase? Refinancing grinds to a halt. And with bonds, the holding period extends (called extension risk) outward in years. Understand, bond prices fall by the average duration in years in percentage terms for every one percent increase in interest rates.

You’re partnering with cities and states when you “invest” in munis. Who do you think will be paid first when it’s a question of paying retirees or investors? I think the answer is obvious, based on historical evidence such as how the bailout of GM was handled. The investor class was left for dead. Don’t let that be you.

Heather Gillers explains in the Wall Street Journal that defaults in the muni market are higher than normal, writing:

Defaults, a rarity in the muni market, remain higher than during the pre-pandemic period, though they have fallen from 2020, according to Municipal Market Analytics. Some borrowers have fared particularly badly. There were 33 defaults in 2021 among assisted-living and other senior-housing borrowers, the most since the firm’s record-keeping began in 2009.

Some state and local governments also remain on shaky ground, using bond money to plug budget gaps or relying on stimulus funds to paper over financial problems. Towns across the U.S. in 2021 resorted to pension-obligation borrowing, using a record-breaking amount of debt to top up retirement funds in the hopes that market returns will outpace interest costs.

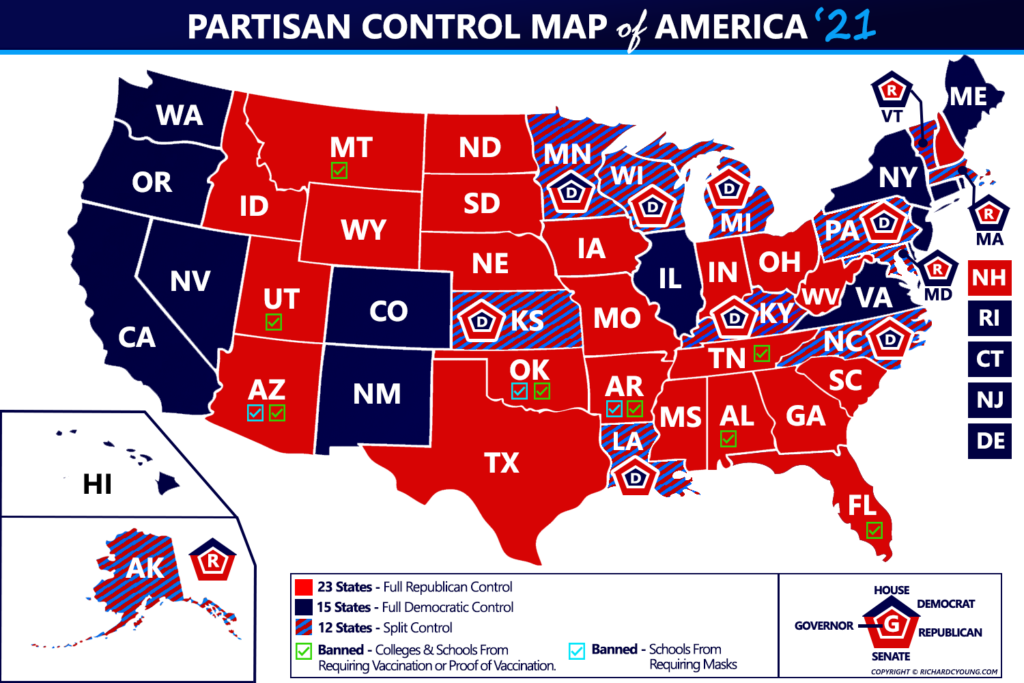

Action Line: Don’t let politics ruin your portfolio because, yes, politics matter when it comes to investing. And based on what I see on the city and state levels, you don’t want to partner with the deep blue ones. Keep your eye on what’s happening in America’s states and cities by signing up for my monthly RAGE Gauge alert.

Originally posted on Your Survival Guy.