You know from recent posts how Your Survival Guy feels about too much power in too few hands. What I’m talking about is when the big three fund companies, BlackRock, State Street, and Vanguard, with their immense size, vote your shares with their politics.

There was a time when indexing in stocks made sense. But what we have today is so much money chasing the same stuff. It’s like frogs in a pot. Too much consolidation of money with both stocks and bonds.

When it comes to your bond money, I like a bond ladder where you control the height or length of it with differing maturities and quality. You don’t just want any ladder, do you?

What I like most about an individually curated bond ladder is that you’re in control. Because when you’re in a bond fund, you may be a long-term-minded investor, but that doesn’t mean the other guy is. When times get tough, they may turn to the exits, requiring your bond fund manager to sell at a less-than-opportune time. That’s not necessarily fair to you, is it? Remember, risk tolerance is often learned after the fact.

But here’s the kicker. When you get to a certain point in your life, I don’t want you climbing ladders. It’s dangerous. Your days of risking a fall should be behind you. Plus, you can call me instead. And unlike trying to get “a guy” to show up. I’ll return your call personally. That’s why I’m here.

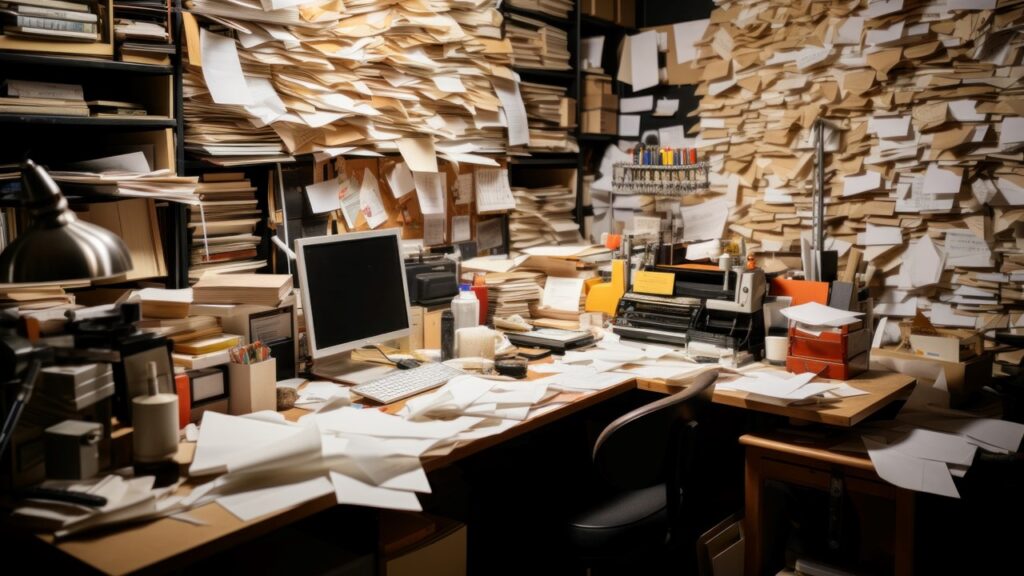

Action Line: Time to put a ladder up against your house and clean up your bond clutter. Contact Your Survival Guy to get your spring cleaning.

Originally posted on Your Survival Guy.