UPDATE 8.22.23: With bond yields rising higher than they’ve been for some time, it’s a good time to review duration. Bond duration is a measure of the change in price for a bond given a one percentage point change in interest rates. Every time interest rates rise, bond prices fall, and vice versa. Different bonds respond with greater or lesser volatility to changes in interest rates, and the magnitude of that change is measured by the bond’s duration. Below is an update to the interest rate table I posted back in March 2022. Look how rates have changed. Investors in bonds today are actually getting paid something for their money.

| Instruments | 2023 Aug 14 |

2023 Aug 15 |

2023 Aug 16 |

2023 Aug 17 |

2023 Aug 18 |

|---|---|---|---|---|---|

| Federal funds (effective) | 5.33 | 5.33 | 5.33 | 5.33 | 5.33 |

| Commercial Paper | |||||

| Nonfinancial | |||||

| 1-month | n.a. | 5.33 | 5.30 | 5.28 | 5.32 |

| 2-month | 5.34 | 5.34 | 5.31 | n.a. | 5.32 |

| 3-month | 5.32 | n.a. | n.a. | n.a. | n.a. |

| Financial | |||||

| 1-month | n.a. | 5.36 | n.a. | n.a. | n.a. |

| 2-month | n.a. | n.a. | n.a. | n.a. | n.a. |

| 3-month | 5.42 | 5.47 | 5.39 | 5.39 | 5.43 |

| Bank prime loan | 8.50 | 8.50 | 8.50 | 8.50 | 8.50 |

| Discount window primary credit | 5.50 | 5.50 | 5.50 | 5.50 | 5.50 |

| U.S. government securities | |||||

| Treasury bills (secondary market) | |||||

| 4-week | 5.28 | 5.27 | 5.26 | 5.28 | 5.27 |

| 3-month | 5.29 | 5.29 | 5.29 | 5.29 | 5.28 |

| 6-month | 5.29 | 5.28 | 5.28 | 5.27 | 5.26 |

| 1-year | 5.08 | 5.08 | 5.09 | 5.08 | 5.07 |

| Treasury constant maturities | |||||

| Nominal | |||||

| 1-month | 5.55 | 5.53 | 5.52 | 5.55 | 5.53 |

| 3-month | 5.56 | 5.56 | 5.56 | 5.56 | 5.55 |

| 6-month | 5.56 | 5.55 | 5.54 | 5.53 | 5.52 |

| 1-year | 5.37 | 5.36 | 5.37 | 5.36 | 5.35 |

| 2-year | 4.96 | 4.92 | 4.97 | 4.94 | 4.92 |

| 3-year | 4.64 | 4.64 | 4.68 | 4.67 | 4.63 |

| 5-year | 4.36 | 4.36 | 4.42 | 4.42 | 4.38 |

| 7-year | 4.29 | 4.31 | 4.37 | 4.38 | 4.34 |

| 10-year | 4.19 | 4.21 | 4.28 | 4.30 | 4.26 |

| 20-year | 4.46 | 4.49 | 4.55 | 4.58 | 4.55 |

| 30-year | 4.29 | 4.32 | 4.38 | 4.41 | 4.38 |

| Inflation indexed | |||||

| 5-year | 2.07 | 2.12 | 2.19 | 2.18 | 2.16 |

| 7-year | 1.93 | 1.98 | 2.05 | 2.06 | 2.03 |

| 10-year | 1.83 | 1.89 | 1.96 | 1.97 | 1.94 |

| 20-year | 1.88 | 1.93 | 1.98 | 2.01 | 1.99 |

| 30-year | 1.98 | 2.02 | 2.06 | 2.09 | 2.08 |

| Inflation-indexed long-term average | 2.03 | 2.08 | 2.11 | 2.15 | 2.13 |

Originally posted March 23, 2022.

In my conversations with you, you’re asking, “Hey, Survival Guy, why are bond prices down? Aren’t they supposed to be our anchor to windward?”

“Of course, they are,” I say, “but bond prices decline as interest rates rise.”

“Well, don’t take this the wrong way Survival Guy, but isn’t it obvious rates are going higher?” you say.

“About as obvious as predicting Covid or the war in Ukraine,” I respond.

Look, I’m Your Survival Guy, not Your Hope and a Prayer Guy. I know how ugly stock and bond markets can get, and I don’t get too worked up about temporary declines in prices. Your Survival Guy hasn’t sold his bonds. Your Survival Guy hasn’t sold his stocks. He always keeps a balanced portfolio and personally, just invested more in the market this week.

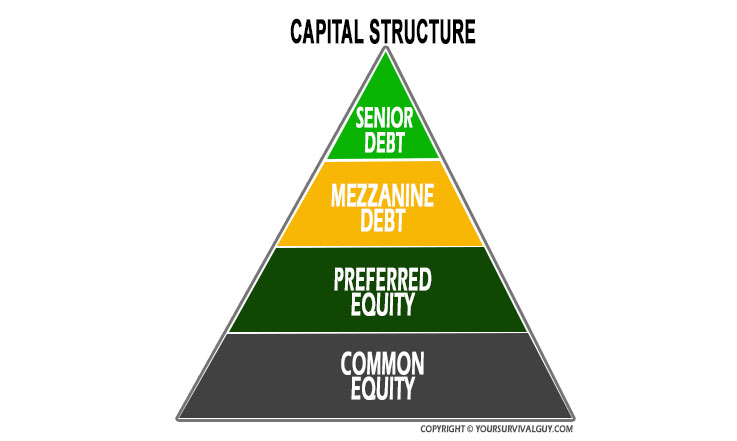

Your key in times like these is to understand why you do what you do. For me, I get a ton of peace of mind knowing that the importance of the Survival Guy Capital Structure pyramid hasn’t changed one bit. I know, I know, bonds are boring, blah, blah, blah. But you know what? When the you-know-what really hits the fan, bondholders get paid well before common shareholders. I like that. And if you’re in or near retirement, getting a return of principal matters a whole lot more than your return on it.

Don’t hate Your Survival Guy for this low interest rate environment and inflated assets. This is a formula for DISASTER constructed by economists at the Federal Reserve—a political beast if I’ve ever seen one. With that in mind, understand that bond price sensitivity, or duration, is a function of maturity and interest rates. The longer the maturity, the more sensitive prices are to interest rates (up and down).

Take a look at this table from the Federal Reserve below. Your Survival Guy sees the sweet spot around 3-years. That’s where I do my business today, and I’d suggest the same for you. Sure, there are values further out on the curve that are ripe for the picking. In the meantime, don’t be pushed out of your bonds. No one said this was going to be easy.

| Instruments | 2022 | 2022 | 2022 | 2022 | 2022 |

| Mar | Mar | Mar | Mar | Mar | |

| 15 | 16 | 17 | 18 | 21 | |

| Federal funds (effective) | 0.08 | 0.08 | 0.33 | 0.33 | 0.33 |

| Commercial Paper | |||||

| Nonfinancial | |||||

| 1-month | n.a. | 0.36 | 0.35 | 0.36 | 0.34 |

| 2-month | n.a. | n.a. | 0.62 | 0.65 | n.a. |

| 3-month | n.a. | n.a. | n.a. | n.a. | n.a. |

| Financial | |||||

| 1-month | 0.44 | n.a. | 0.59 | 0.46 | 0.49 |

| 2-month | n.a. | n.a. | n.a. | 0.63 | n.a. |

| 3-month | 0.91 | 0.90 | 1.01 | 0.80 | 0.79 |

| Bank prime loan | 3.25 | 3.25 | 3.50 | 3.50 | 3.50 |

| Discount window primary credit | 0.25 | 0.25 | 0.50 | 0.50 | 0.50 |

| U.S. government securities | |||||

| Treasury bills (secondary market) | |||||

| 4-week | 0.21 | 0.23 | 0.20 | 0.19 | 0.21 |

| 3-month | 0.46 | 0.43 | 0.40 | 0.41 | 0.55 |

| 6-month | 0.84 | 0.84 | 0.79 | 0.80 | 0.93 |

| 1-year | 1.19 | 1.26 | 1.20 | 1.19 | 1.28 |

| Treasury constant maturities | |||||

| Nominal | |||||

| 1-month | 0.22 | 0.24 | 0.20 | 0.19 | 0.22 |

| 3-month | 0.46 | 0.44 | 0.40 | 0.42 | 0.54 |

| 6-month | 0.86 | 0.86 | 0.81 | 0.83 | 0.95 |

| 1-year | 1.28 | 1.35 | 1.30 | 1.29 | 1.40 |

| 2-year | 1.85 | 1.95 | 1.94 | 1.97 | 2.14 |

| 3-year | 2.04 | 2.14 | 2.14 | 2.15 | 2.34 |

| 5-year | 2.10 | 2.18 | 2.17 | 2.14 | 2.33 |

| 7-year | 2.16 | 2.22 | 2.22 | 2.17 | 2.36 |

| 10-year | 2.15 | 2.19 | 2.20 | 2.14 | 2.32 |

| 20-year | 2.57 | 2.56 | 2.60 | 2.53 | 2.67 |

| 30-year | 2.49 | 2.46 | 2.50 | 2.42 | 2.55 |

| Inflation indexed | |||||

| 5-year | -1.32 | -1.16 | -1.34 | -1.34 | -1.19 |

| 7-year | -0.98 | -0.86 | -1.00 | -1.00 | -0.86 |

| 10-year | -0.69 | -0.61 | -0.71 | -0.72 | -0.58 |

| 20-year | -0.25 | -0.22 | -0.29 | -0.30 | -0.19 |

| 30-year | -0.03 | -0.02 | -0.08 | -0.09 | 0.01 |

| Inflation-indexed long-term average | -0.09 | -0.07 | -0.13 | -0.14 | -0.03 |

Action Line: I want all the success in the world for you. You know being successful isn’t easy. It requires discipline and getting up early–not the one-two punch most think about in retirement. That’s OK. That’s my job. Stick with Your Survival Guy here. And if you want to talk, you know how to reach me.

Originally posted on Your Survival Guy.