I hear it all the time. “I don’t understand bonds.” So I’m going to clear that up for you. But first, let me just say, it’s a real disservice to successful Americans like you to be told, ad nauseam, that we’re in a “bond bubble of epic proportions.” Listen, I want you to be a calm, cool, and collected investor, not a mad man. Talking stocks is a holiday tradition. But the reason you own bonds—wait for it—is so you can own stocks. That’s it. Period. End of story. That’s all you need to know to understand bonds.

Look, the stock market discounts everyone’s best and worst ideas. Putting your real money, you know your life’s savings, to work is serious business. I remember like it was yesterday when I first started working with Richard Young in the late 90s. I would be amazed at his concentration on a specific problem and how he could think it through. His concentration and seriousness, whether investing a hundred grand or a million bucks, was off the charts. That memory is branded into my brain like a stray steer in Costner’s Yellowstone because the business of investing is serious. Period.

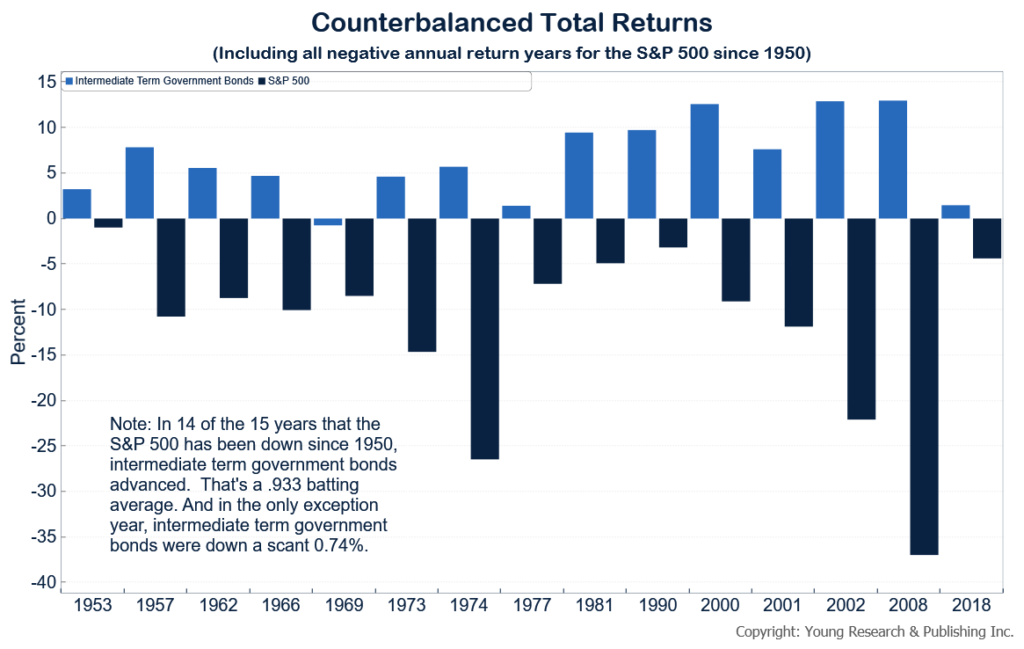

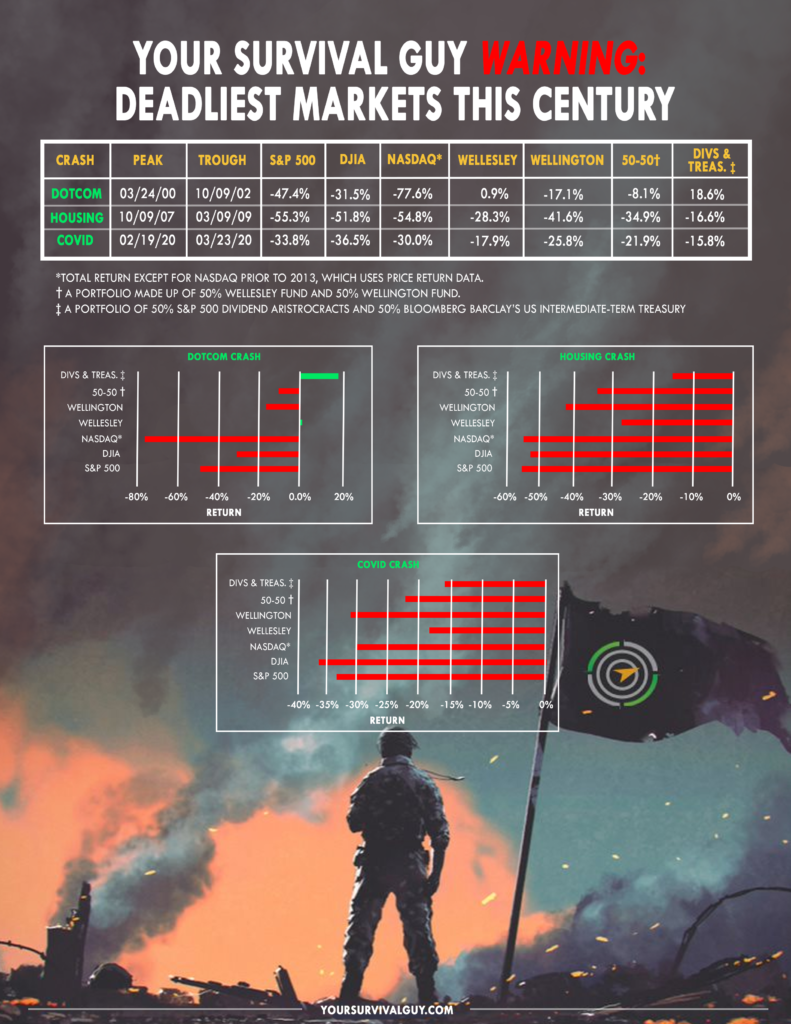

Is there anything more serious than your money? No. Because you can talk about your love of family until the dogs come home, but if you don’t have any money to support it, then what’s the point? You lose your freedom, your way of life, and someone else is sitting at the head of your Christmas dinner table. So, yes, bonds matter. They’re your anchor to windward and give you the counterbalance you need to survive rough markets.

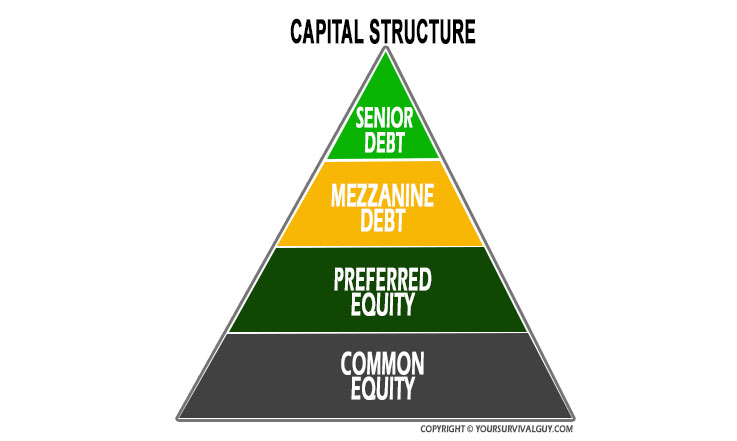

Does that mean bonds will automatically go up when stocks fall? I’m Your Survival Guy, not the Farmer’s Almanac. But, the fact of the matter is, as a bondholder, you rise above common shareholders in a company’s capital structure like a spirit. You, by law, are supposed to be paid before the commoners. Remember the Nifty Fifty of the 70s? Most are gone. Bad stuff. It happens. Plan accordingly.

Action Line: Understand that every dollar you invest competes with the smartest and the dumbest. The market doesn’t care about IQ. That’s why it’s irresponsible to tell investors to move money from the top of the pyramid to the bottom simply to chase returns. Your job is to keep what you make, understand the forces working against you, and invest with the seriousness your family deserves. Let’s talk.

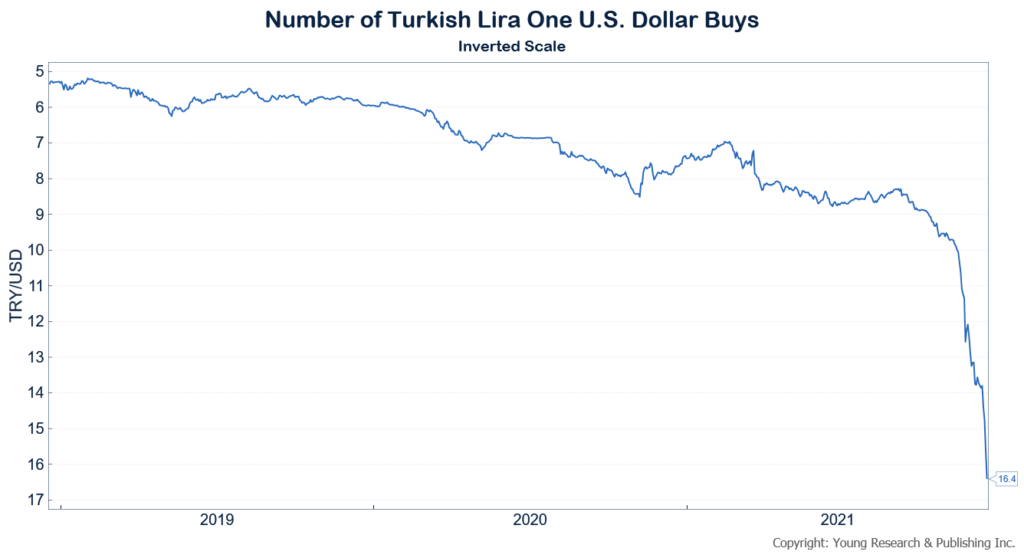

P.S. Look at Turkey, and its currency, the Lira. Don’t speculate with your bond money. And understand how important the currency is in which you’ll be paid.

Originally posted on Your Survival Guy.