It’s in times like these where you need to have Your Survival Guy investment plan in place and be vigilant about your personal security. You need to start off by understanding the value of compound interest, and of counterbalanced portfolio returns. Those are the foundations of any investment plan that seeks to ride through storms like the one in Europe today. The war in Ukraine is causing large increases in oil supplies as oil traders prepare for possible bans on Russian oil. The Wall Street Journal reports:

The S&P 500 dropped 1.4%, while the Dow Jones Industrial Average declined 1.2%, or about 406 points. The tech-heavy Nasdaq Composite lost 1.7%.

The war in Ukraine, now in its 12th day, has roiled commodity markets, increased tensions between Moscow and the West and led to Russia being unplugged from much of the global financial system.

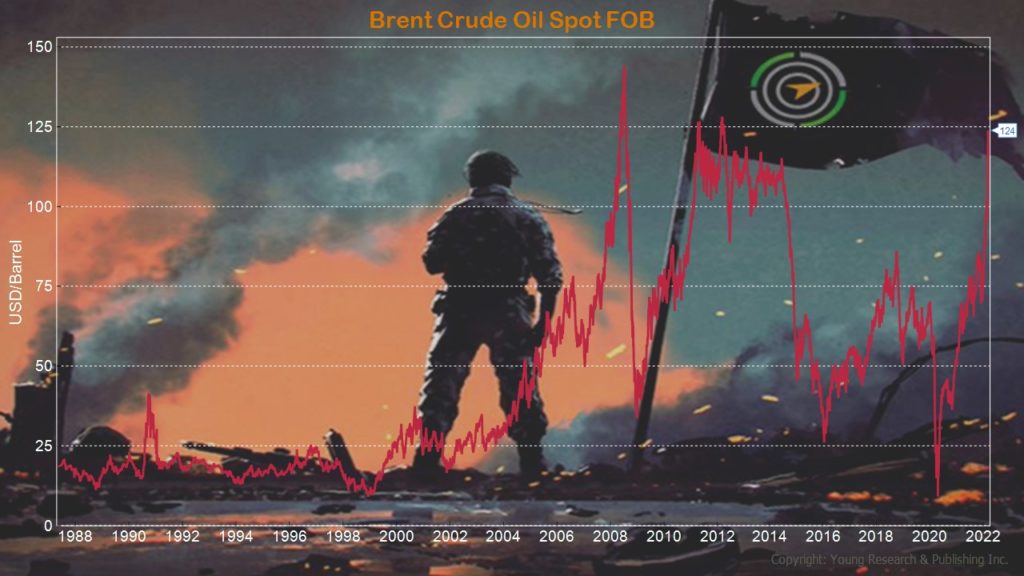

Oil prices rose, easing off their highs on the day, with global benchmark Brent crude adding 3.3% to $122.07 a barrel. Earlier Monday, it topped $130, the highest level since July 2008. The U.S. equivalent, West Texas Intermediate, rose 1.8% to $117.74. The U.S. and European partners are discussing a ban on imports of Russian oil, Secretary of State Antony Blinken said Sunday.

Rising oil prices are triggering fears about demand destruction and a global recession, said Michael Hewson, chief markets analyst at CMC Markets. “It’s hard to see much in the way of significant upside for stock markets now against a backdrop of continued escalation” in Ukraine, he said.

The pan-continental Stoxx Europe 600 fell 0.2% Monday. Germany’s DAX stock index and Italy’s FTSE MIB fell into bear market territory. Surging oil and gas prices are spurring concerns that Europe, an energy importer dependent on Russia, could fall into recession.

Among individual stocks, Occidental Petroleum jumped 3.8% after activist investor Carl Icahn exited his position, after years of campaigns. Bed Bath & Beyond rose 62% after billionaire investor Ryan Cohen disclosed a 9.8% stake in the retailer.

Higher commodity prices and the resulting accelerated inflation are complicating the next moves of major central banks, who were largely set to begin tightening monetary policy before the war began. The European Central Bank is meeting this week, and investors will be watching for changes to its growth outlook and what this could mean for policy.

“This toxic cocktail poses a huge problem for central banks. Do they tighten monetary policy and risk pushing the world into a recession even quicker or do they allow inflation to rip higher, which would do the same thing?” Mr. Hewson said. Inflation concerns are weighing on the bond market, he added.

Action Line: If you need help building a portfolio with market turbulence in mind, I would love to talk with you. If you would like to get to know me before we talk on the phone, there’s no better way than signing up for my free monthly Survive & Thrive letter. In the letter each month, I encourage and push you to achieve the personal and financial security goals you’ve set for your family. Click here to subscribe. We’ll get to know each other, and get serious about your future success.

Originally posted on Your Survival Guy.