Copper is said to have a PhD. in economics because it has been one of the most reliable real-time barometers of the economy. With much of the world’s demand growth coming from outside the U.S. it might be more appropriate to say copper has a PhD. in global economics.

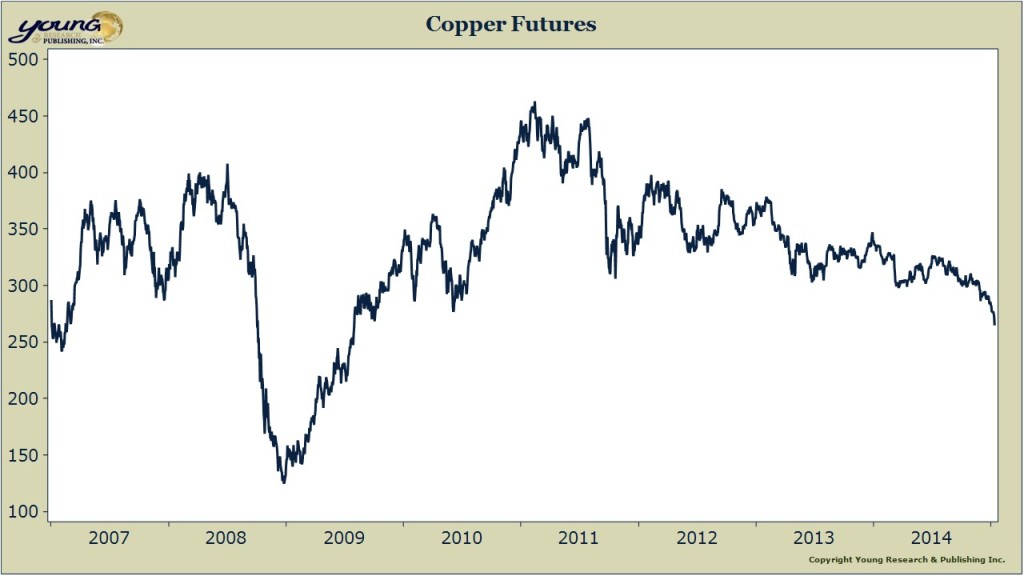

What does copper and the global economy have to do with oil? Well, the narrative in the financial press is that the collapse in oil prices is a supply story. The explanation I read most often is that the Saudi’s are in a battle for market share with U.S. shale producers (as if this makes any sense, topic for another day though). An excess of oil supply may be part of the reason for the slide in oil prices, but if PhD. Copper can be trusted, there is also a demand component here. Copper prices are trading at a more than four year low. There is no OPEC market share battle going on for copper so why are prices falling? And it is not just copper prices that are sliding. Iron ore, aluminimum, nickel, steel, and even rubber are all trending down.

Could it be that the slide in oil and copper prices are a result of falling demand as much as rising supply?