Well sort of. James Paulsen of Wells Capital Management, one of the most outspoken bulls of today’s bubble market is raising the red flag of caution. Why has Paulsen turned more bearish on the U.S. stock market? Based on a recent missive posted on his website it would appear Mr. Paulsen has fingered the biggest bubble (in a broad sense) in at least six decades as a risk to the market.

Well sort of. James Paulsen of Wells Capital Management, one of the most outspoken bulls of today’s bubble market is raising the red flag of caution. Why has Paulsen turned more bearish on the U.S. stock market? Based on a recent missive posted on his website it would appear Mr. Paulsen has fingered the biggest bubble (in a broad sense) in at least six decades as a risk to the market.

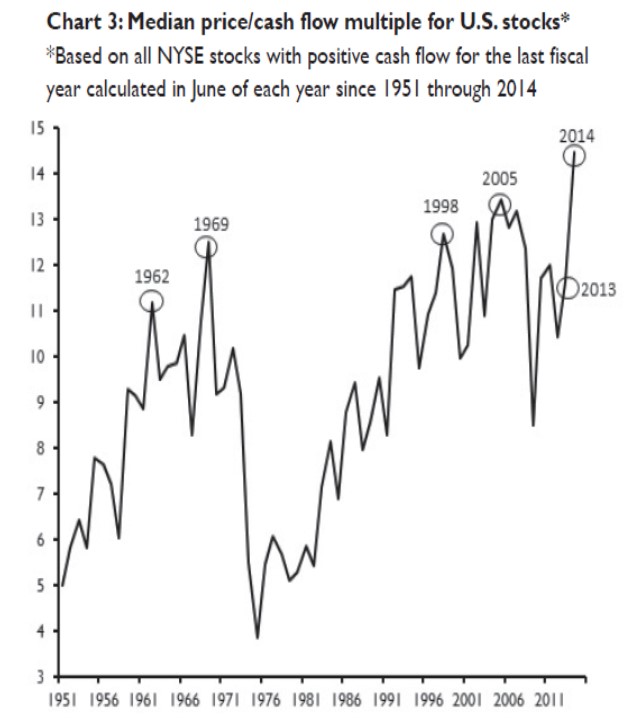

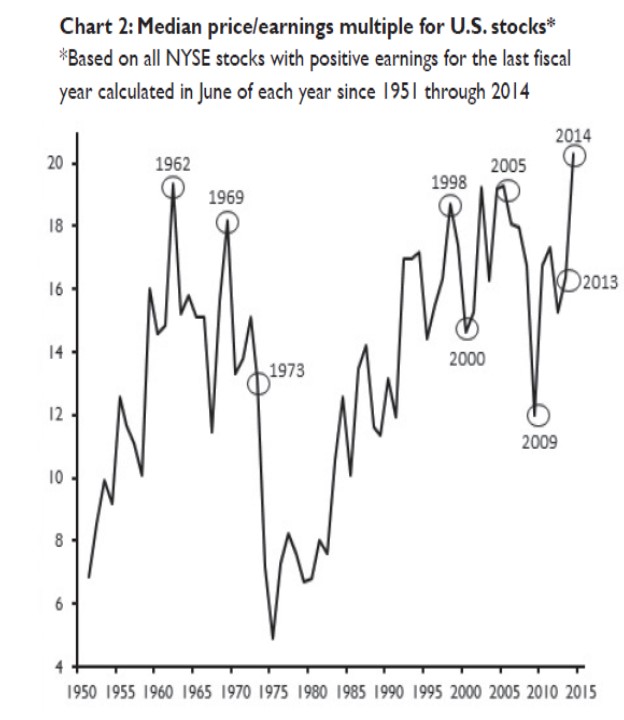

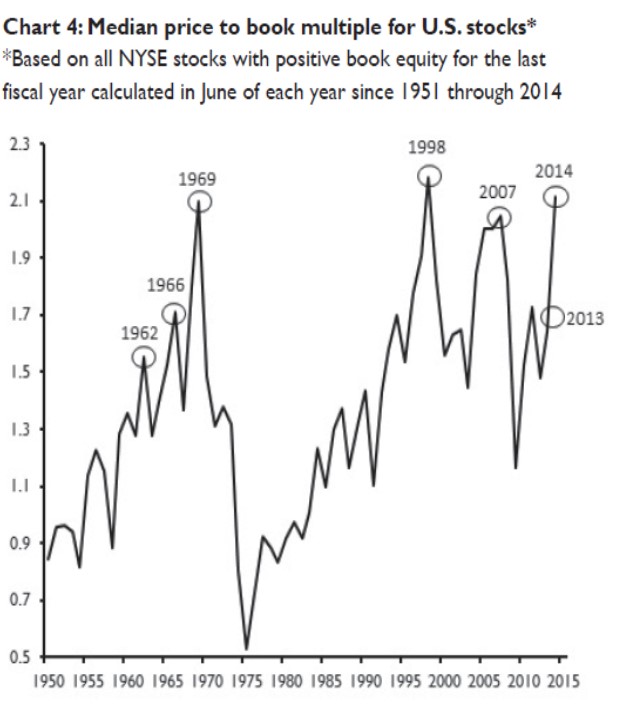

As Mr. Paulsen rightly points out, the Median P/E of NYSE stocks is at a post-war record. That is saying something. This is the most expensive stock market in your investing lifetime. And it’s not just P/E ratios that show stocks are expensive. The Median stock is trading at or near record valuations on the basis of earnings, cash flow, and book value. See charts below.

Why do high median valuations matter? Here’s some of what Mr. Paulsen concludes

First, the valuations of U.S. stocks are much higher today than widely perceived or as suggested by the valuation of the popular S&P 500 Index. Moreover, today’s valuation extreme is not limited only to a subset of stock market sectors but rather is very widespread whereby nearly all P/E multiple percentiles are at or close to post-war records. Finally, the current valuation extreme is not the result of poor performance from a single valuation metric. U.S. stocks are broadly and richly priced compared to earnings, cash flows, and book values.

Second, because valuation dispersion is relatively low today, there are not many areas to hide from overvaluation. In 1973 or 2000, investors could reduce extraordinary valuation risk by simply diversifying away from the Nifty Fifty or new era tech stocks. Today, because values are both high and tight, lessening valuation risk may not be possible except by allocating away from U.S. stocks.

Sixth, historically when the valuation of the median NYSE stock has been as high as it is today (e.g., from Chart 2 consider 1962, 1969, 1998, 2000, 2005, and 2007), the overall stock market has usually either suffered an outright bear market (i.e., in 1962, 1969, 2000-2001, and 2007-2008) or a correction (i.e., in 1998). Only in 2005, from a similar median stock valuation, did the overall stock market avoid a correction or bear market until 2008. At a minimum, this historic record suggests investors should proceed with greater caution.

We wouldn’t disagree with any of this.