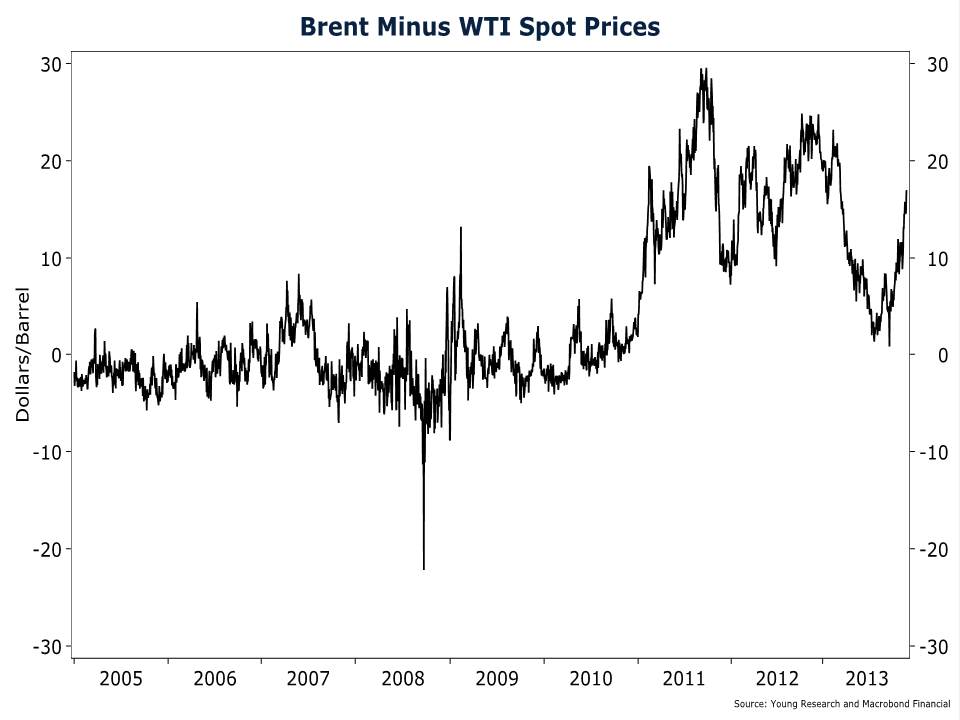

After the difference in the spot market prices of Brent crude and WTI crude peaked in 2011, another slightly lower peak formed in late 2012, and now it appears the differential is widening again at the end of 2013. You can see on the chart below that in matter of only 68 days, the price differential has expanded by 1873%, from a mere $0.86/barrel to $16.97/barrel.

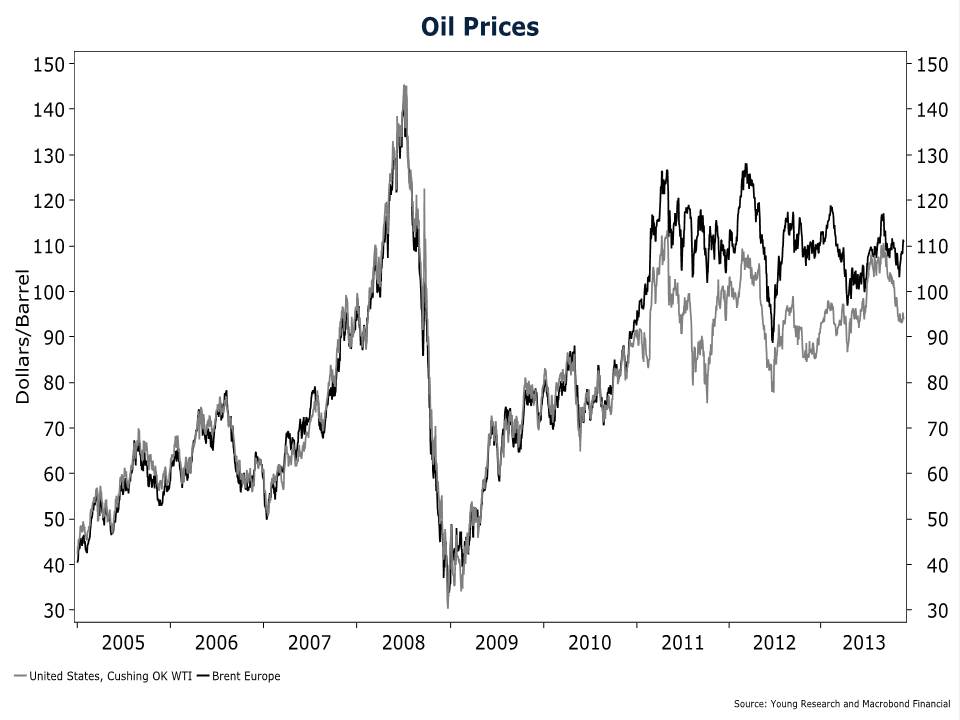

As you can see on the next chart. Prices for WTI started diverging from the internationally used Brent benchmark in 2011, whereas beforehand the prices had tracked each other quite closely. A glut of new oil production in the United States from shale oil deposits and increased production from mature fields has led to the price discrepancies.

It remains to be seen whether relief of supply bottlenecks in Oklahoma where WTI is priced will push the price higher, or whether the increased global supply will bring the Brent price lower in the long-term. Perhaps both effects will occur simultaneously.