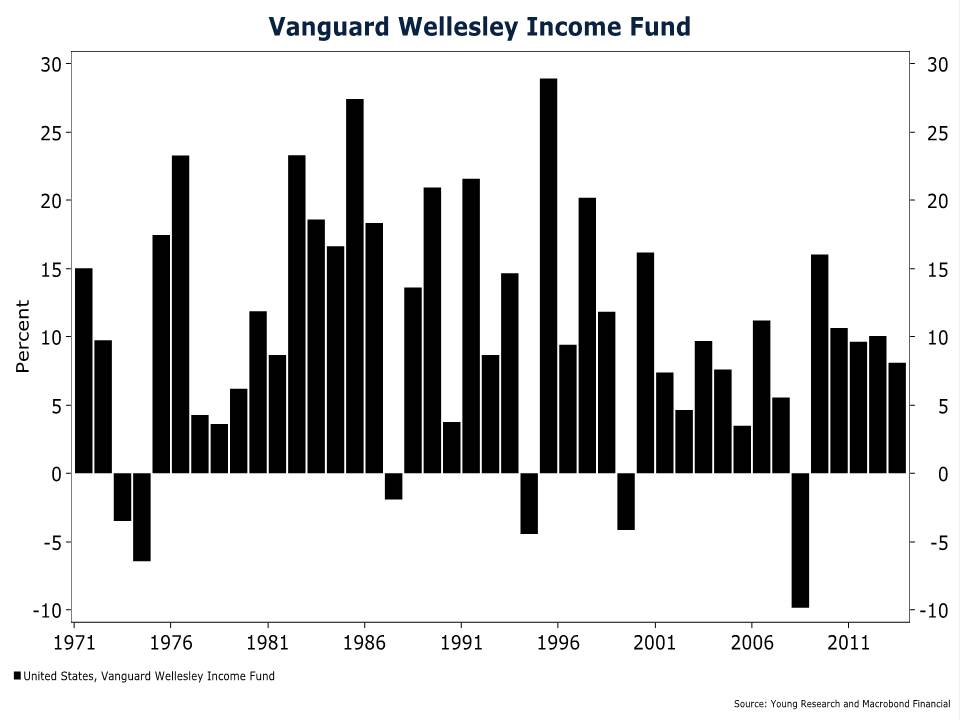

A counterbalanced portfolio is your key to investment success. For an example of how counterbalancing works I’ll point you to the Vanguard Wellesley fund. For my taste, a “one size fits all” fund simply does not exist today. But this one comes pretty close. Take a look at the years where stocks were destroyed. When you’re in retirement or close to it, you can’t afford to take the big hits. Counterbalancing—the 60% bonds and 40% stocks in Wellesley—helps to ease the pain.

E.J. Smith works with new investors that have $2 million or more to invest. He can be reached at:ejsmith@youngresearch.com