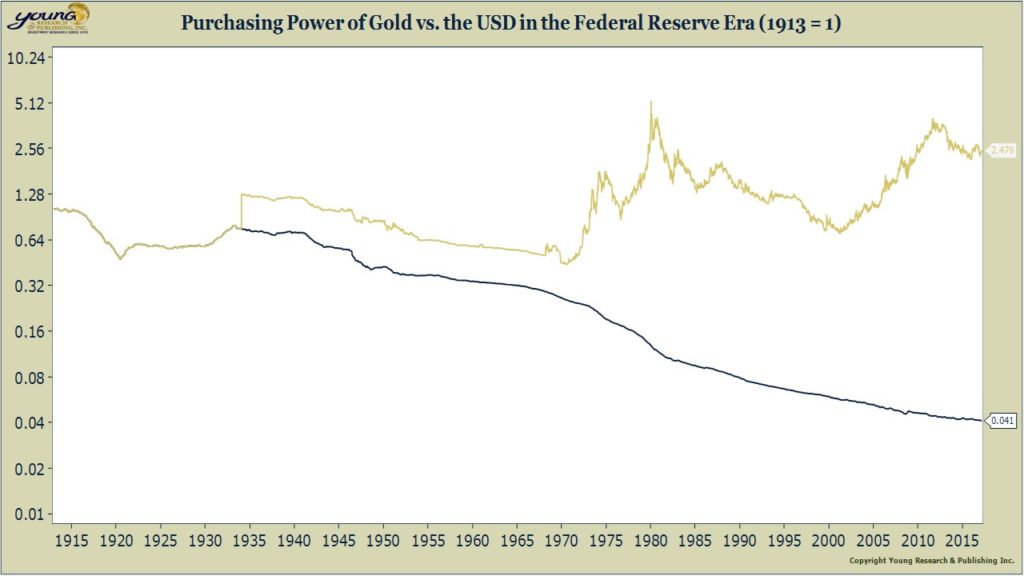

One of the lines in the chart below is the purchasing power of the USD, and the other is the purchasing power of an ounce of gold. Both series are rebased to one in 1913, the year the esteemed Federal Reserve was created.

Since the Fed was created, the U.S. dollar has lost 96% of its purchasing power while gold has gained purchasing power.

That’s no coincidence.

Gold is a store of value. A wealth preservation vehicle.

Gold won’t make you rich, but it won’t make you poor either.

Gold is a currency. It can’t go bankrupt, lose its value because of poor management, accounting fraud, world war, hyper-inflation, or out of control government spending.

If you truly understand gold, you recognize that your gold should be counted in ounces, not dollars. Because while the dollar value of gold may fluctuate from year-to-year, it will be worth many times its current value during the next generation and in those that follow.