High dividend small-cap stocks can be a source of fresh dividend investing ideas, but just as buying the highest dividend paying large stocks can come with significant risk, so too does investing in high dividend small-cap stocks.

Below we explain the opportunities and risks of high dividend small-cap stocks and provide a list of some of the highest dividend paying small-cap stocks.

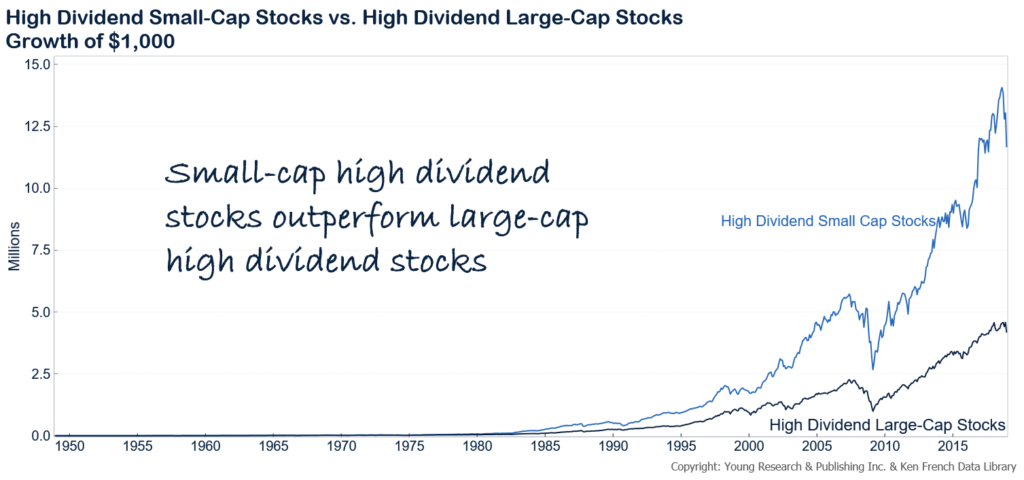

Historically small dividend stocks have outperformed large dividend stocks.

The chart below compares the performance of small-cap dividend stocks to large cap dividend stocks. From year-end 1948 through 2018, small-cap dividend stocks outperformed large cap dividend stocks by almost two percentage points annually.

Performance of High Dividend Small-cap Stocks

What’s 2%? A two percentage point advantage for high dividend paying small stocks may sound small, but compound interest is a powerful force.

Over the course of 60 years, the 2% advantage of high dividend small-cap stocks was worth an additional $7.5 million on an initial $1,000 investment.

High Yielding Small Stocks are riskier than High Yielding Large-Cap Stocks

Like most things in investing (except diversification), there is no free lunch. Small-cap high dividend stocks are riskier than large-cap high dividend stocks.

Since 1948, high yielding small stocks have been about 25% more volatile than high yielding large stocks as measured by the standard deviation of both market segments. Standard deviation is a measure of volatility or variability. It provides an indication of the ups and downs an investor can expect.

The higher standard deviation of small-cap high dividend stocks means investors should anticipate more frequent and wider ups and downs than with large high dividend stocks.

Is the Risk worth the Return in High Yield Small Stocks?

If you are an aggressive investor, the prospect of higher returns in small-cap high yield stocks may be worth the additional risk. Before you go out and load your portfolio with small-cap dividend stocks, though, it is important to realize two things about the historical performance of high yield small stocks compared to high yield large cap stocks.

First, transaction costs on small stocks were much higher relative to large cap stocks than they are today. Commissions were higher and bid-ask spreads were wider in the past. Buying a basket of small company stocks to spread risk also wasn’t as easy back then. The result: the returns of a hypothetical $1,000 investment in small-cap high dividend stocks may have overestimated the results an actual investor could realize after transaction costs.

The second item to keep in mind is that in the past, information and research on small company stocks was not as easily accessible to the investing public. Obtaining hard copies of SEC filings (the only way to get them back then) wasn’t as easy as it is today. Nor was pulling up the historical financial records of a small-cap company.

More Information Available on Small Stocks Today

Information on small-cap stocks still isn’t as widely available as it is on large caps, but it is much more accessible than in the past. Today anybody can quickly pull up historical financial statements, company news, and a company’s latest regulatory filings on the Internet.

Lower transaction costs and a more level playing field for investors may have lowered the return premium of small-cap high dividend stocks. The table below shows the return of small-cap high dividend stocks versus large cap high dividend stocks by decade.

Small-cap high dividend stocks outperformed significantly in the 1960s, 1970s, and 1980s. Over the last three decades, however, their return advantage has been less consistent, including a decade of lagging performance in the 1990s and 2010s.

Performance of High Dividend Small-cap Stocks by Decade

| Decade | High Div Small-Caps (CAGR) | High Div Large-Caps (CAGR) | Difference |

| 1950s | 18.4% | 18.8% | -0.4% |

| 1960s | 12.5% | 9.6% | 2.9% |

| 1970s | 12.8% | 9.7% | 3.0% |

| 1980s | 21.9% | 19.8% | 2.1% |

| 1990s | 13.0% | 13.7% | -0.7% |

| 2000s | 9.4% | 5.1% | 4.3% |

| 2010s* | 11.3% | 12.0% | -0.7% |

*through October of 2019

Our intention isn’t to dissuade you from considering an investment in high yielding small-cap stocks, but to inform you of the opportunities and the risks. Below you will find a list of the top high dividend small-cap stocks (we excluded REITs from the list). Many of the yields may be too good to be true. And while there may be a gem or two in the bunch, buying the 10 highest dividend paying Russell 2000 stocks (index of small-caps) has a dismal historical record.

Since year-end 1995, buying the 10 highest dividend paying stocks in the Russell 2000 (rebalanced annually) would have lost 69% compared to a 473% gain in the underlying index.

Buyer beware is the phrase to keep in mind.

List of High Dividend Small-cap Stocks in the Russell 2000

Gannett (GCI) • 25.8% yield

Gannett is a local newspaper company. Gannett owns USA Today and more than 260 daily newspapers and hundreds of weeklies. Gannett publishes 30% of all newspapers in the U.S. every day.

Amplify Energy (AMPY) • 14.0% yield

Amplify Energy is an independent oil and gas exploration and production company.

Quad Graphics (QUAD) • 13.3% yield

Quad Graphics is a commercial printing and graphics design company. The company’s services include graphic design, imaging, print production, as well as mailing and distribution.

Vector Group (VGR) • 12.3% yield

Vector sells cigarettes in the U.S. Vector’s major discount brands include Eagle 20’s, Pyramid, Grand Prix, Liggett Select, and Eve.

B&G Foods (BGS) • 10.9% yield

B&G Foods is a packaged foods company that sells foods such as salsa, maple syrup, pickles, baked beans, and meat spreads, among other products.

AMC Entertainment (AMC) • 9.9% yield

AMC is the #1 movie theater chain in the world. AMC owns or has an interest in 660 theaters with 8,200 screens.

National CineMedia (NCMI) • 9.8% yield

National CineMedia distributes in-theater advertising on over 20,000 movie screens across the U.S.

Westwood Holdings (WHG) • 9.8% yield

Westwood Holdings is an institutional investment management firm. Westwood provides investment management to institutions and mutual funds.

Advanced Emissions Solutions (ADES) • 9.6% yield

Advanced Emissions Solutions offers advanced mercury and acid gas control solutions for coal-fueled power plants.

Ellington Financial (EFC) • 9.2% yield

Ellington Financial is a specialty finance company that acquires and manages commercial and residential mortgage loans.