How’s everyone feeling about this market? Well, if you’ve been following my dividend-centric, individual bond ladder approach, it hasn’t been all that bad. In fact, it’s been good to finally see markets get down to reality. You can’t have tech valuations based on thin air multiples forever. Or can you? We’ll see. But this isn’t a forecasting piece. The weather is what it is. I like dealing within areas I can control. My favorite being how much I save and how much I work. Isn’t that the key to everyone’s success?

There was a time when America was an idea that championed the self-reliant—the individual under God. Our founders believed in it. And, in rereading Roger Babson’s (founder of Babson College) Prosperity, he explains how our founders were looking to God, not gold. They didn’t come to America in search of treasure to pillage. They came to create one—a way of life. And yet, here we are today where so many look at you like you’re an ATM—and they want to cash in on your lifetime of work and sacrifice.

It’s because of your work and your savings that we’re even talking this morning. You’ve done the hard work. I’m trying to help you avoid the big mistakes of losing it all—mistakes that are all too common in this business. As illustrated to you yesterday, it’s not surprising to me that so many investors have nothing to show for their lifetime of savings in the stock market. They are just too careless with their money.

As Arthur Laffer and Stephen Moore write in The Wall Street Journal:

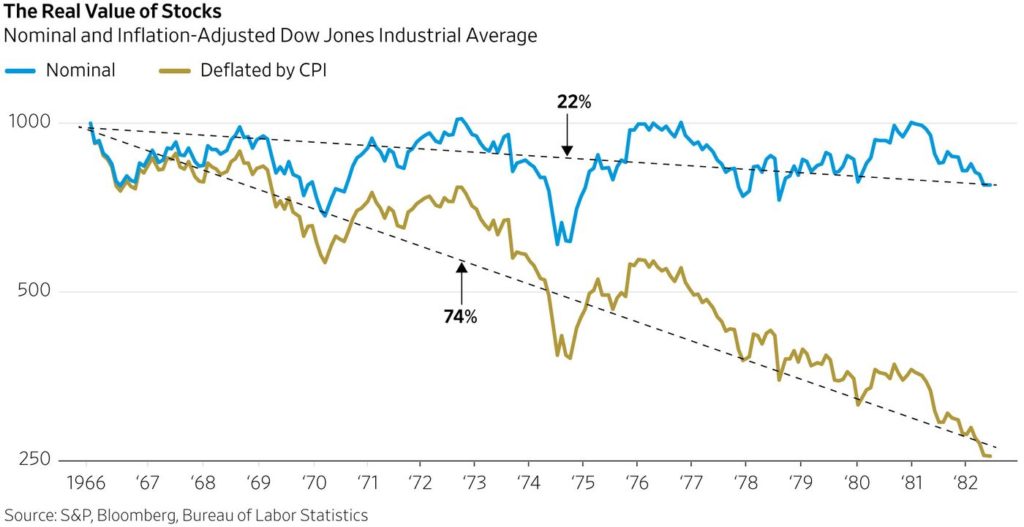

What about the stock market and Americans’ wealth? Mr. Laffer’s warning of a bear market turned out to be spot on. As the nearby chart shows, the Dow Jones Industrial Average briefly climbed above 1000 in the mid-’60s and then bottomed out at 777 in the summer of 1982—a 22% reduction in stock values in nominal terms.

But investors, like workers, care about their real return. Adjusted for inflation, the industrial average (and the S&P 500) fell during that period by more than 70%—the worst 15-year stock performance since the crash of 1929. President Ronald Reagan and Fed Chairman Paul Volcker had to sweat the 11% inflation out of the system through a return to a stable-dollar regime along with supply-side tax cuts that encouraged the production of more goods and services. A bull market ensued, with the Dow Jones Industrial Average rising to more than 30000 between 1982 and 2022. Over that 40-year period inflation averaged a benign 3%—until the arrival of President Biden and the Modern Monetary Theory crowd.

Being careless is a killer. The second you lose a dollar that dollar is dead, never to return ever again. All the time and effort you spent earning that dollar are wiped out in a loss. It’s the saddest thing. Really it is. But it happens every single day because in a zero-sum game like the stock market every trade has a winner and a loser. It’s just a matter of time to realize the magnitude of each.

Action Line: Long term investment success is a way of life. It’s a religion. If you understand this, then you’re with me. You’re searching for something bigger than gold. You’re searching with self-reliance for something you can build a life upon and be proud of. Stay with me.

Originally posted on Your Survival Guy.